Increased Urbanization

The trend of urbanization is contributing significantly to the growth of the security robots market. As more people move to urban areas, the demand for effective security solutions rises. Cities are becoming densely populated, leading to increased crime rates and the need for enhanced surveillance. The security robots market is adapting to these changes by providing solutions that can monitor large areas efficiently. Urban environments present unique challenges, and security robots are being designed to navigate these complexities. The integration of these robots into urban security strategies is likely to become more prevalent, as municipalities seek to leverage technology to ensure public safety.

Cost Efficiency and ROI

Organizations are increasingly recognizing the cost benefits associated with deploying security robots. The initial investment in security robots can be offset by the reduction in labor costs and the potential for improved security outcomes. The security robots market is seeing a shift as businesses calculate the return on investment (ROI) from these technologies. For example, a study indicates that companies can save up to 30% on security-related expenses by utilizing robotic solutions. This financial incentive is driving more companies to consider security robots as a viable alternative to traditional security personnel. As the cost of technology continues to decrease, the adoption of security robots is expected to rise, further propelling the market forward.

Rising Security Concerns

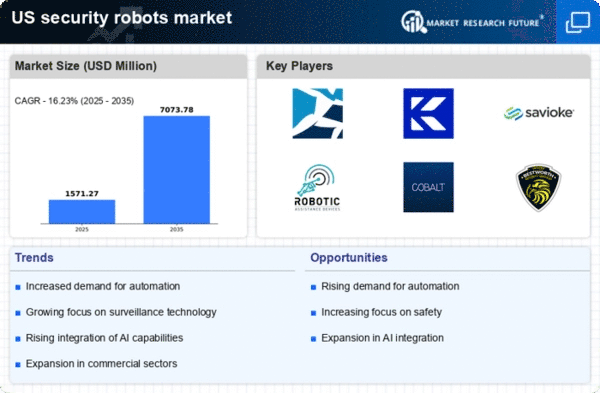

The increasing prevalence of crime and security threats in urban areas has led to a heightened demand for advanced security solutions. The security robots market is experiencing growth as businesses and residential areas seek to enhance their safety measures. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates that organizations are investing in technology that can provide real-time surveillance and rapid response capabilities. As security concerns escalate, the adoption of security robots is likely to become a standard practice in various sectors, including retail, hospitality, and public safety. The security robots market is thus positioned to benefit from this growing awareness and the need for innovative security solutions.

Technological Advancements

The rapid evolution of technology, particularly in robotics and artificial intelligence, is a key driver for the security robots market. Innovations such as enhanced sensors, improved navigation systems, and advanced data analytics are making security robots more effective and reliable. For instance, the integration of machine learning algorithms allows these robots to adapt to their environments and improve their performance over time. The security robots market is witnessing a surge in the development of autonomous systems capable of performing complex tasks, which was not feasible a few years ago. This technological progress not only enhances the functionality of security robots but also reduces operational costs, making them more accessible to a wider range of users.

Evolving Regulatory Landscape

The regulatory environment surrounding security technologies is evolving, which impacts the security robots market. Governments are increasingly recognizing the importance of integrating advanced security measures in public and private sectors. New regulations may encourage the adoption of security robots by providing guidelines for their use and ensuring compliance with safety standards. The security robots market is likely to benefit from these developments, as businesses seek to align with regulatory requirements while enhancing their security capabilities. This evolving landscape may also foster innovation, as companies strive to meet new standards and leverage technology to improve security outcomes.