Rising Global Food Demand

The increasing global population and subsequent rise in food demand are significant drivers of the Global Agricultural Crop Insurance Market Industry. As the world population is projected to reach approximately 9.7 billion by 2050, the pressure on agricultural production intensifies. Farmers are compelled to adopt more resilient practices and safeguard their crops against potential losses through insurance. This trend is likely to propel the market, as the need for reliable crop insurance becomes more pronounced. The anticipated growth in the agricultural sector necessitates robust insurance solutions to ensure food security, thereby reinforcing the importance of crop insurance in global agriculture.

Increasing Climate Variability

The Global Agricultural Crop Insurance Market Industry is significantly influenced by the rising climate variability, which poses substantial risks to crop yields. Farmers face unpredictable weather patterns, including droughts and floods, which can devastate agricultural production. As a response, the demand for crop insurance is expected to rise, with the market projected to reach 17.3 USD Billion in 2024. This growing awareness of climate risks encourages farmers to seek insurance solutions that can mitigate potential losses, thereby driving the market forward. Insurers are adapting their offerings to cover a wider range of climate-related risks, which may further enhance market growth.

Government Support and Subsidies

Government initiatives play a pivotal role in shaping the Global Agricultural Crop Insurance Market Industry. Various countries implement subsidy programs to encourage farmers to purchase crop insurance, thereby enhancing agricultural resilience. For instance, in the United States, the Federal Crop Insurance program provides substantial financial support to farmers, which has led to increased participation in insurance schemes. Such government backing not only boosts farmer confidence but also contributes to the market's expansion, with projections indicating a market size of 27.4 USD Billion by 2035. This support is crucial for ensuring that farmers can manage risks effectively and sustain their livelihoods.

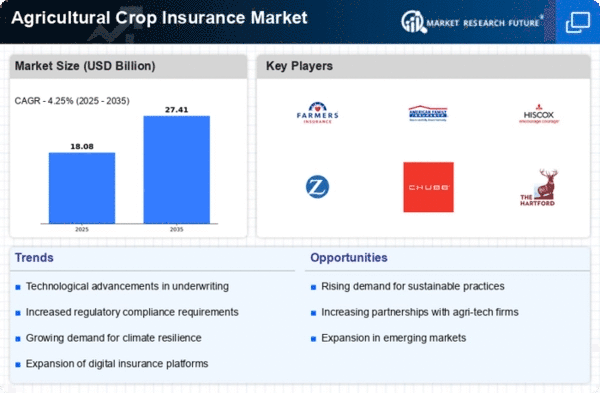

Market Size and Growth Projections

The Global Agricultural Crop Insurance Market Industry is characterized by robust growth projections, with the market expected to reach 17.3 USD Billion in 2024 and 27.4 USD Billion by 2035. This growth trajectory reflects the increasing recognition of crop insurance as a vital tool for risk management in agriculture. The compound annual growth rate of 4.25% from 2025 to 2035 highlights the sustained demand for insurance products as farmers seek to protect their livelihoods against various risks. Such metrics underscore the importance of the crop insurance market in supporting agricultural sustainability and resilience.

Market Trends and Consumer Awareness

Consumer awareness regarding the importance of crop insurance is steadily increasing, influencing the Global Agricultural Crop Insurance Market Industry. Farmers are becoming more informed about the benefits of insurance in protecting their investments against unforeseen events. This heightened awareness is leading to a greater willingness to invest in insurance products, thereby expanding the market. Additionally, market trends indicate a shift towards more comprehensive coverage options that address a variety of risks, including pest infestations and market fluctuations. As farmers recognize the value of insurance in ensuring financial stability, the market is poised for continued growth.

Technological Advancements in Risk Assessment

Technological innovations are transforming the Global Agricultural Crop Insurance Market Industry by enhancing risk assessment methodologies. Advanced data analytics, satellite imagery, and machine learning algorithms are being employed to evaluate crop health and predict potential losses more accurately. These technologies enable insurers to offer tailored policies that reflect the specific risks faced by farmers. As a result, the market is likely to experience a compound annual growth rate of 4.25% from 2025 to 2035. By improving the precision of risk assessments, technology not only increases the efficiency of insurance processes but also fosters greater trust among farmers in insurance products.