Increasing Demand for Food Security

The rising The Crop Protection Chemicals Industry into a critical position. As agricultural productivity must increase to meet the needs of an estimated 9.7 billion people by 2050, the reliance on crop protection chemicals becomes paramount. These chemicals play a vital role in enhancing crop yields and ensuring food security. According to recent data, the agricultural sector is expected to grow significantly, with crop protection chemicals being a key component in achieving sustainable agricultural practices. This increasing demand for food security drives innovation and investment in the Crop Protection Chemicals Market, as stakeholders seek effective solutions to combat pests and diseases that threaten crop production.

Regulatory Pressures and Compliance

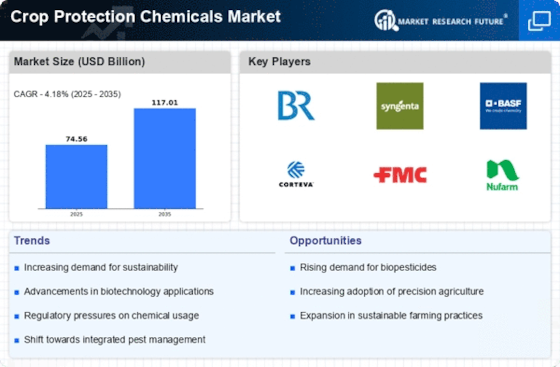

Regulatory pressures are increasingly influencing the Crop Protection Chemicals Market, as governments worldwide implement stricter guidelines on chemical usage. Compliance with these regulations is essential for manufacturers and distributors, as non-compliance can lead to significant penalties and market access issues. The need for transparency and safety in chemical applications is driving innovation, as companies invest in research and development to create safer and more effective products. This regulatory landscape presents both challenges and opportunities for the Crop Protection Chemicals Market, as firms that adapt to these changes can gain a competitive edge while contributing to sustainable agricultural practices.

Rising Awareness of Sustainable Agriculture

The rising awareness of sustainable agriculture practices is significantly impacting the Crop Protection Chemicals Market. Consumers are increasingly concerned about the environmental and health implications of chemical usage in agriculture, prompting a shift towards more sustainable options. This trend is reflected in the growing demand for organic produce and products that utilize environmentally friendly crop protection chemicals. As a result, manufacturers are compelled to innovate and develop products that align with these consumer preferences. The emphasis on sustainability not only influences purchasing decisions but also shapes the strategic direction of the Crop Protection Chemicals Market, as stakeholders seek to balance productivity with ecological responsibility.

Adoption of Integrated Pest Management (IPM)

The adoption of Integrated Pest Management (IPM) strategies is transforming the Crop Protection Chemicals Market. IPM emphasizes the use of a combination of biological, cultural, and chemical practices to manage pests effectively while minimizing environmental impact. This holistic approach not only enhances the efficacy of crop protection chemicals but also aligns with the growing consumer demand for sustainable agricultural practices. As farmers increasingly adopt IPM, the market for crop protection chemicals is likely to expand, with a focus on products that are compatible with these strategies. The shift towards IPM is indicative of a broader trend within the Crop Protection Chemicals Market, where sustainability and efficiency are becoming paramount.

Technological Innovations in Crop Protection

Technological innovations are reshaping the Crop Protection Chemicals Market, leading to the development of more effective and environmentally friendly products. Advances in biotechnology, such as genetically modified organisms (GMOs) and precision agriculture, are enabling farmers to utilize crop protection chemicals more efficiently. For instance, the use of drones and satellite imagery allows for targeted application of these chemicals, reducing waste and enhancing effectiveness. The market is witnessing a surge in demand for biopesticides and other sustainable alternatives, reflecting a shift towards greener solutions. This trend not only addresses environmental concerns but also meets regulatory requirements, further driving growth in the Crop Protection Chemicals Market.