Top Industry Leaders in the Agriculture Bactericides Market

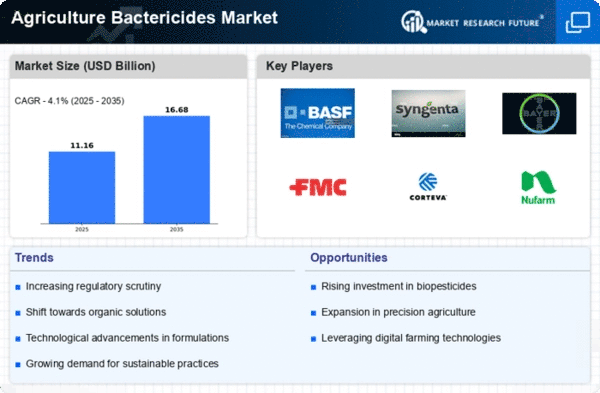

The agricultural bactericides market, a crucial segment within the broader agrochemical industry, plays a pivotal role in safeguarding global crop yields. As the demand for sustainable and efficient agricultural practices continues to rise, the competitive landscape of bactericides is evolving dynamically. This analysis explores the key players, strategies employed, market share determinants, emerging companies, industry news, and investment trends shaping the current competitive scenario in the agricultural bactericides market.

The agricultural bactericides market, a crucial segment within the broader agrochemical industry, plays a pivotal role in safeguarding global crop yields. As the demand for sustainable and efficient agricultural practices continues to rise, the competitive landscape of bactericides is evolving dynamically. This analysis explores the key players, strategies employed, market share determinants, emerging companies, industry news, and investment trends shaping the current competitive scenario in the agricultural bactericides market.

Key Players:

- Biocides Private Limited

- FMC Corporation

- Biostadt India Limited

- Aries Agro Ltd.

- Nippon Soda Co. Ltd.

- Syngenta AG

- Adama Agricultural Solutions Ltd.

- BASF SE

- American Vanguard Corporation

- Nufarm Limited

- PI Industries

- Sumitomo Chemical Co. Ltd

- GREENCHEM BIOTECH

- Dow AgroSciences LLC

- Bayer CropScience AG

Strategies Adopted: Surviving and thriving in the agricultural bactericides market necessitates the adoption of strategic approaches. Key players often focus on research and development, aiming to introduce novel bactericides that are not only effective against pathogens but also environmentally sustainable. Bayer CropScience, for example, invests significantly in R&D to develop solutions that address emerging challenges, such as pesticide resistance.

Market players also engage in strategic collaborations and partnerships. Syngenta's alliances with agricultural research institutions and universities exemplify this approach. Such collaborations enable access to cutting-edge research, enhance product development capabilities, and expand market presence.

Moreover, companies emphasize marketing strategies to create brand awareness and promote the efficacy of their bactericides. BASF SE, with its global marketing initiatives, strategically positions its products to meet diverse regional needs, maintaining a competitive edge.

Factors for Market Share Analysis: Several factors influence the market share analysis of agricultural bactericides. Research and development investments play a crucial role, as companies introducing innovative and efficacious solutions often capture a larger market share. The ability to adapt to changing regulations and environmental concerns is another determinant, as sustainable and environmentally friendly bactericides gain preference among consumers.

Global market reach and distribution networks are pivotal factors. DowDuPont's expansive distribution channels ensure the availability of its bactericides to a wide range of farmers globally, contributing to its market share. Additionally, the effectiveness of bactericides in controlling and preventing diseases, coupled with their compatibility with integrated pest management practices, impacts market share significantly.

Customer relationships and support services also contribute to market share. FMC Corporation's commitment to providing technical support and training to farmers enhances the value proposition of its bactericides, fostering customer loyalty and market share growth.

New and Emerging Companies: While established players dominate, the agricultural bactericides market sees the emergence of new and innovative companies. These entrants often focus on niche markets or introduce specialized solutions to address specific agricultural challenges. Biopesticides, derived from natural sources, represent a growing trend, with companies like Marrone Bio Innovations and Certis USA gaining traction.

The emphasis on biological and organic solutions is a notable trend among emerging companies. Marrone Bio Innovations, for instance, specializes in bio-based products, offering alternatives to conventional bactericides. These companies challenge traditional norms, providing sustainable and eco-friendly options that resonate with a consumer base increasingly conscious of environmental impact.

Industry News: Staying abreast of industry news is critical in understanding the competitive dynamics of the agricultural bactericides market. Recent developments include advancements in nanotechnology for targeted delivery of bactericides, improving their efficacy and minimizing environmental impact. The market has also witnessed increased collaboration between agrochemical companies and technology firms to integrate data-driven solutions into pest and disease management strategies.

The emergence of CRISPR-based technologies for crop protection is reshaping the landscape, with companies exploring gene-editing techniques to enhance plant resistance. Additionally, regulatory updates and shifts in consumer preferences towards sustainable agriculture practices influence the direction of research and development initiatives.

Current Company Investment Trends: Investment trends within the agricultural bactericides market underscore the industry's commitment to innovation and sustainability. Companies are allocating substantial resources to research and development, aiming to introduce next-generation bactericides with improved efficacy and reduced environmental impact. This includes investments in advanced formulation technologies, nanotechnology applications, and biopesticide development.

Sustainability remains a key focus, with companies investing in eco-friendly solutions and exploring ways to reduce the environmental footprint of their products. The adoption of precision agriculture technologies, such as drones and sensors, is also on the rise, allowing for targeted and efficient application of bactericides.

Mergers and acquisitions are prevalent, as companies seek to enhance their product portfolios and consolidate market share. Collaborations between agrochemical companies and biotechnology firms highlight a trend towards integrated solutions that leverage both biological and chemical approaches for crop protection.

Overall Competitive Scenario: In conclusion, the competitive landscape of the agricultural bactericides market is characterized by a balance between industry giants and nimble innovators. Key players leverage extensive research and development capabilities, strategic collaborations, and global market reach to maintain leadership positions. Factors influencing market share include innovation, regulatory adaptability, global distribution networks, and customer-centric approaches.

The emergence of new companies, particularly those focusing on bio-based and sustainable solutions, injects dynamism into the market. Industry news reflects ongoing advancements, such as nanotechnology and gene editing, shaping the future of bactericides. Current investment trends highlight a commitment to innovation, sustainability, and the integration of technology into crop protection strategies.

As the agricultural bactericides market continues to evolve, companies that can navigate regulatory landscapes, embrace technological advancements, and address environmental concerns are poised to thrive in this competitive and vital sector, ensuring the resilience and sustainability of global agriculture.

Recent News :

Bayer CropScience AG (BAYN):

Introduced Serenade Acima, a biofungicide with bactericidal properties, offering a natural and sustainable solution for controlling bacterial diseases in fruit and vegetable crops.

Partnered with research institutions to develop novel bacteriophages, viruses that target specific bacteria, aiming for a revolutionary pest control method.

Syngenta AG (SYNGF):

Expanded the label for Quadris® fungicide, allowing its use against bacterial diseases in certain crops, providing growers with a broader spectrum of protection.

Invested in startups developing next-generation biocontrol agents like RNAi technology, paving the way for targeted and environmentally friendly solutions.

BASF SE (BASF):

Acquired a leading biocontrol company, strengthening their portfolio of natural bactericides and accelerating their entry into this growing segment.

Focused on integrated pest management (IPM) approaches, combining bactericides with other strategies like crop rotation and biological control for sustainable disease control.

Nufarm Limited (NUF):

Launched Astarte™, a new copper-based bactericide with extended residual activity, offering enhanced protection against bacterial diseases in vineyards and orchards.

Emphasized research and development on alternative delivery systems like drones and precision spraying technologies to optimize bactericide application and minimize environmental impact.