Research Methodology on Agriculture Bactericides Market

The research process adopted for putting together the report on the ‘Agriculture Bactericides Market’ was based on in-depth secondary research (market study database, textbooks, press releases of associations, paid databases, etc.), followed by primary research subject to parameters of relevance in the current study.

SECONDARY RESEARCH

In this process, comprehensive research was conducted by referring to industry forums and databases such as Hoovers, Bloomberg Business, Factiva, OneSource, and OECD, among others. Moreover, researchers referred to company websites and financial reports of various companies. Data was analyzed using the triangulation method i.e. a combination of demand-side and supply-side analysis was used to arrive at market estimates.

PRIMARY RESEARCH

Secondary research was complemented by primary research to further validate & refine the value proposition offered in the study. Market players, having a significant share in the market were contacted. For this purpose, various sources were used, such as industry associations, conferences, market players, interviews, and surveys. A thorough analysis of data and information collected through primary and secondary research processes was done, followed by proper validation & filtering, before it was included as a part of the research process.

APPROACHES USED

Extensive primary research undertaken for this report, with the help of the demand side and supply side, was based on the following approaches:

1. Bottom-Up Approach

It was used for deriving the overall market size of the global ‘Agriculture Bactericides Market’ from the revenues of the key players in the market. This was also used to estimate the overall market size at the regional level.

2. Top Down Approach

It was used for validating the size of the global ‘Agriculture Bactericides Market’ with the help of already available market size datasets.

3. Factor Analysis

It was employed to assess internal as well as external factors essential for this market study.

4. Time-Series Analysis

The historical data was tested for carrying out the future forecast.

5. Demand Side and Supply Side Data Triangulation

The demand-side and supply-side data was incorporated to determine the total market size of the global ‘Agriculture Bactericides Market’.

RESEARCH ASSUMPTIONS

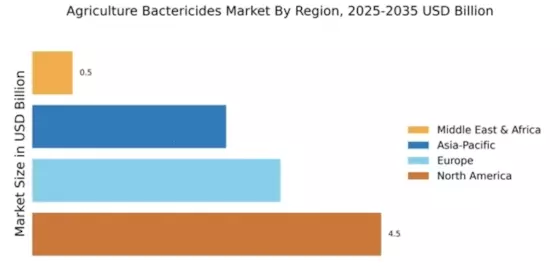

- A percentage split for geographic regions was used in the study to estimate the overall size of the global ‘Agriculture Bactericides Market’. This percentage split was derived from the secondary research conducted.

- The prices used in the market study were derived from the pricing of the products and offerings of key players in the respective geographical region. This price was further compared and validated by industry experts.

- The exchange rates for the USD against other currencies including GBP, INR, BRL, etc. are assumed to remain constant for the forecast period 2023 to 2030.

- The forecast model relies on meticulous research methodologies and assumptions that are subject to the dynamic changes in the market and its impact on the global ‘Agriculture Bactericides Market’.

- A thorough sales and revenue analysis was conducted for the market estimation.

MARKET ESTIMATION PROCESS

The analysis of the ‘Agriculture Bactericides Market’ entailed the triangulation of data collected through primary and secondary research to obtain estimates of the market and private players in specific regions.

DATA VALIDATION

Data triangulation methods were used to verify and validate the data gathered from primary research and secondary research. The continuous tracking of the global ‘Agriculture Bactericides Market’ helps identify the latest industry trends and growth opportunities.

SCOPE OF THE REPORT

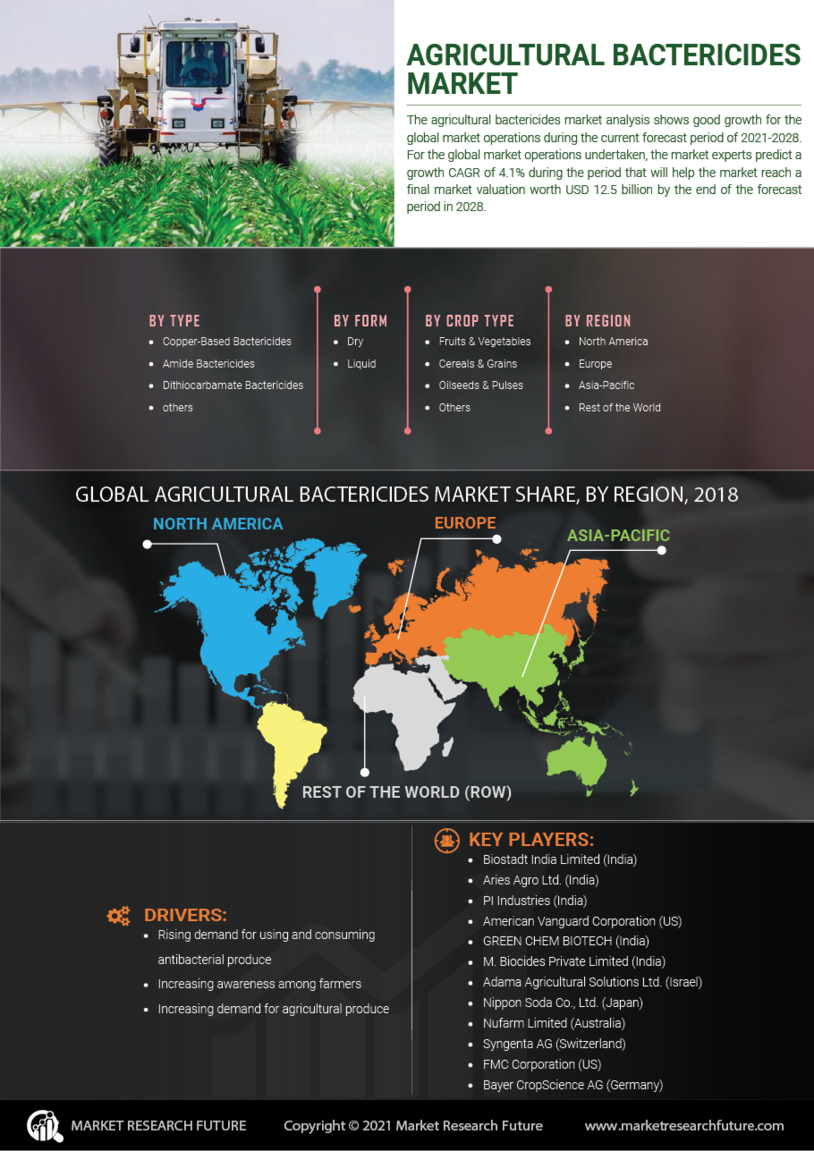

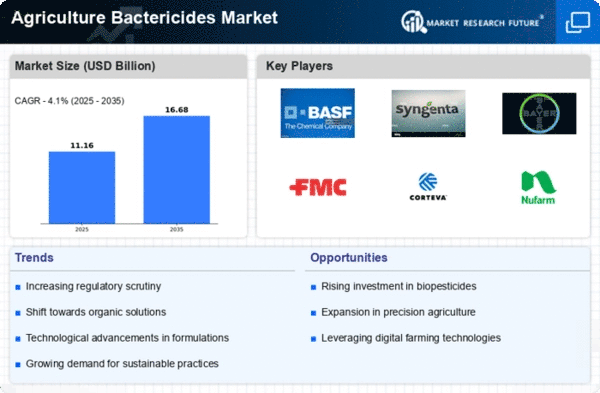

Factors influencing the growth of the ‘Agriculture Bactericides Market’, such as drivers, restraints, and opportunities have been comprehensively covered in the report.

Analysis covers estimation and forecast of the ‘Agriculture Bactericides Market’ from 2023 to 2030.

Different market segmentations such as by ingredient type, product type, form, application, pest type, and target crop have been discussed in the report.

A comprehensive analysis of the key market players, current market trends and opportunities, and future outlook of the ‘Agriculture Bactericides Market’ have also been featured in the report.

Porter's five forces analysis has also been included to understand the market scenario better.