Rising Demand for Food Security

The increasing global population necessitates enhanced food production, thereby driving the Agrochemical Active Ingredients Market. As agricultural practices evolve, the need for effective crop protection and yield enhancement becomes paramount. According to recent estimates, the world population is projected to reach approximately 9.7 billion by 2050, which implies a significant rise in food demand. This scenario compels farmers to adopt agrochemicals that can maximize productivity while ensuring sustainability. The Agrochemical Active Ingredients Market is thus positioned to benefit from this trend, as it provides essential solutions to meet the growing food requirements. Furthermore, the integration of advanced agrochemical formulations is likely to play a crucial role in addressing the challenges posed by climate change and resource scarcity.

Regulatory Framework and Compliance

The regulatory landscape surrounding agrochemicals is becoming increasingly stringent, impacting the Agrochemical Active Ingredients Market. Governments worldwide are implementing stricter regulations to ensure the safety and efficacy of agrochemical products. This trend necessitates that manufacturers invest in research and development to comply with these regulations, which can be both a challenge and an opportunity. For instance, the European Union's REACH regulation mandates comprehensive safety assessments for chemical substances, influencing product development strategies. As a result, companies in the Agrochemical Active Ingredients Market are likely to focus on innovation and transparency to meet regulatory requirements while maintaining competitiveness. This evolving regulatory framework may also lead to the emergence of new market players specializing in compliant agrochemical solutions.

The Agrochemical Active Ingredients Access

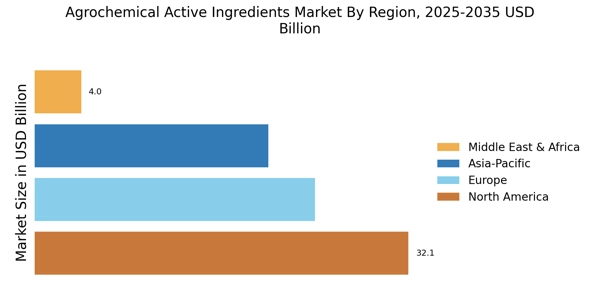

The dynamics of The Agrochemical Active Ingredients Industry. Trade agreements and tariffs can affect the availability and pricing of agrochemical products across different regions. For instance, changes in trade policies may either facilitate or hinder market access for agrochemical manufacturers. The ongoing negotiations for trade agreements in various regions could potentially reshape the competitive landscape of the Agrochemical Active Ingredients Market. Additionally, emerging markets are increasingly becoming focal points for agrochemical companies seeking growth opportunities. As these markets develop their agricultural sectors, the demand for effective agrochemical solutions is likely to rise, presenting both challenges and opportunities for industry players. Understanding these trade dynamics is crucial for stakeholders aiming to navigate the complexities of the Agrochemical Active Ingredients Market.

Technological Advancements in Agrochemicals

Innovations in agrochemical formulations and application technologies are transforming the Agrochemical Active Ingredients Market. The advent of precision agriculture, which utilizes data analytics and IoT technologies, allows for targeted application of agrochemicals, thereby enhancing efficiency and reducing waste. For instance, the use of drones for pesticide application is gaining traction, enabling farmers to cover larger areas with precision. This technological shift not only improves crop yields but also minimizes environmental impact. The Agrochemical Active Ingredients Market is expected to witness substantial growth as these technologies become more mainstream, with market analysts projecting a compound annual growth rate of around 5.5% over the next five years. Such advancements are likely to redefine the competitive landscape of the industry.

Increasing Adoption of Sustainable Practices

The Agrochemical Active Ingredients Market is experiencing a notable shift towards sustainability, driven by consumer preferences and regulatory pressures. Farmers are increasingly adopting sustainable agricultural practices, which include the use of biopesticides and organic fertilizers. This trend is partly influenced by the rising awareness of environmental issues and the demand for organic produce. Market data indicates that the organic food market is expected to grow at a CAGR of approximately 10% in the coming years, which in turn fuels the demand for sustainable agrochemical solutions. Consequently, the Agrochemical Active Ingredients Market is likely to adapt by developing products that align with these sustainable practices, thereby ensuring compliance with evolving regulations and meeting consumer expectations.