Rising Investment in Aerospace R&D

The Aircraft AFP and ATL Composites Market is benefiting from a marked increase in investment in aerospace research and development. Governments and private entities are channeling funds into innovative projects aimed at enhancing aircraft performance and sustainability. This influx of capital is fostering the development of advanced composite materials and manufacturing techniques, particularly those utilizing AFP and ATL technologies. Recent reports indicate that global aerospace R&D spending is expected to reach over 30 billion dollars by 2026, reflecting a commitment to innovation in the sector. This investment not only supports the creation of next-generation aircraft but also stimulates the Aircraft AFP and ATL Composites Market by driving demand for cutting-edge materials and processes. As a result, the industry is likely to see accelerated growth and technological advancements.

Expansion of Commercial Aviation Sector

The Aircraft AFP and ATL Composites Market is poised for growth due to the expansion of the commercial aviation sector. As air travel demand continues to rise, airlines are investing in new aircraft to accommodate increasing passenger numbers. This trend is leading to a heightened demand for advanced composite materials, particularly those produced using AFP and ATL technologies. Recent forecasts suggest that the commercial aviation market will grow at a rate of approximately 5% annually over the next decade. This growth is likely to drive the need for lightweight, durable materials that enhance aircraft performance and reduce maintenance costs. Consequently, the Aircraft AFP and ATL Composites Market stands to benefit significantly from this expansion, as manufacturers seek to meet the evolving needs of the aviation sector.

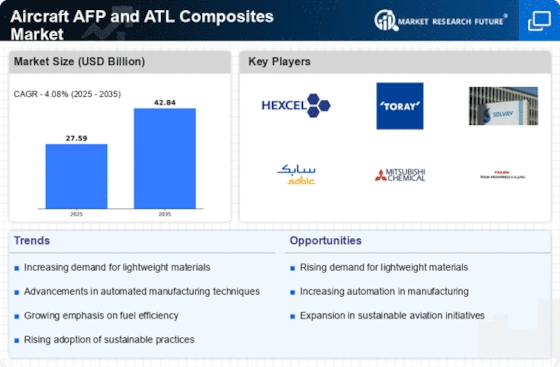

Increasing Demand for Lightweight Materials

The Aircraft AFP and ATL Composites Market is experiencing a notable surge in demand for lightweight materials. This trend is primarily driven by the aviation sector's ongoing efforts to enhance fuel efficiency and reduce emissions. Composites, particularly those manufactured using Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) technologies, offer significant weight savings compared to traditional materials. According to recent data, the use of advanced composites can lead to weight reductions of up to 20% in aircraft structures. This reduction not only contributes to lower operational costs but also aligns with regulatory pressures for greener aviation solutions. As airlines and manufacturers prioritize sustainability, the Aircraft AFP and ATL Composites Market is poised for substantial growth, reflecting a shift towards more efficient and environmentally friendly aircraft designs.

Growing Focus on Fuel Efficiency Regulations

The Aircraft AFP and ATL Composites Market is increasingly influenced by stringent fuel efficiency regulations imposed by aviation authorities worldwide. These regulations are compelling manufacturers to adopt advanced materials and technologies that enhance the aerodynamic performance of aircraft. Composites produced through AFP and ATL methods are particularly well-suited for meeting these regulatory demands, as they allow for the design of lighter and more fuel-efficient aircraft. The International Air Transport Association has set ambitious targets for reducing carbon emissions, which further drives the need for innovative solutions in aircraft design. As compliance with these regulations becomes paramount, the Aircraft AFP and ATL Composites Market is expected to expand, with manufacturers seeking to leverage advanced composites to achieve regulatory compliance and improve operational efficiency.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are playing a pivotal role in shaping the Aircraft AFP and ATL Composites Market. Innovations such as improved automation and precision in AFP and ATL techniques are enhancing production efficiency and product quality. These technologies enable manufacturers to produce complex composite structures with greater accuracy and reduced waste. For instance, the integration of digital twin technology allows for real-time monitoring and optimization of the manufacturing process. As a result, production timelines are shortened, and costs are minimized. The market is projected to witness a compound annual growth rate of approximately 10% over the next five years, driven by these technological innovations. Consequently, the Aircraft AFP and ATL Composites Market is likely to attract increased investment and research, further propelling its expansion.

Leave a Comment