Research Methodology on Aircraft Airframe MRO Market

1. Introduction

Research methodology plays an important role in any research. It helps to identify relevant research areas as well as to ensure that the research process is efficient and accurate in producing quality results. This paper provides an overview of the research methodology adopted by MarketResearchFuture.com while conducting the study titled -Aircraft Airframe MRO Market - Forecast to 2030. The research methodology adopted is based on the research process and design of the study and is aimed at producing quality data and reliable insights into the Aircraft Airframe MRO market.

2. Research Process

The research process adopted for this study has been divided into four stages:

-Research Planning: The first step involves setting up a comprehensive research plan. The research plan involves identifying the research objectives, data requirements, data sources and data collection methods to be used, and the timeline for completion of the study.

-Data Collection and Analysis: The second stage involves collecting primary and secondary data from the identified data sources and performing qualitative and quantitative analysis on the gathered data using various statistical and market analysis techniques.

-Market Estimation and Forecasting: The third stage involves estimating the market size, value and forecast of the Aircraft Airframe MRO market and its various sub-segments.

-Finalization of the Study: The fourth and final stage involves finalizing the study by incorporating all the collected data and analysis in it.

3. Research Design

The research design adopted for this study is based on a combination of primary and secondary research. The primary research was conducted through interviews and surveys of industry experts, and key opinion leaders. The secondary research was conducted by studying various databases and other industry-related publications.

4. Data Sources

The data sources used for this study included:

-Primary Data: The primary data was obtained through interviews and surveys of industry experts, key opinion leaders and industry associations.

-Secondary Data: The secondary data was obtained from various databases such as the United States Department of Transportation, Miami International Airport, Aircraft Airframe MRO Market reports and other relevant industry-specific publications.

5. Market Size Estimation

The market size for the Aircraft Airframe MRO market was estimated using the top-down and bottom-up approaches. In the top-down approach, the global Aircraft Airframe MRO market was divided based on regions. The estimated number of aircraft in the respective region was multiplied by the Average Airframe MRO expenditure to estimate the total Aircraft Airframe MRO market size. In the bottom-up approach, the global Aircraft Airframe Market was divided based on aircraft type. The estimated number of aircraft of each type was multiplied by the Average Airframe MRO expenditure to arrive at the global market size.

6. Forecasting

The market forecast is done using a time-series forecasting approach. Historical data for the Aircraft Airframe MRO Market was collected for the period from 2018 to 2022 and was used to predict the growth rate from 2023 to 2030.

7. Data Validation

The data obtained from various sources was validated through triangulation methods, which involved cross-validation of the data points by making cross-references on different sources. The triangulation method helped in deducing more accurate insights and avoiding discrepancies while making market estimates.

8. Market Taxonomy

The Aircraft Airframe MRO market has been classified based on platform type, component type and region.

By Platform Type: Commercial Aircraft, Military Aircraft, Helicopters and Others;

By Component Type: Fuselage, Landing Gears, Wing, Cabin Interiors and Others;

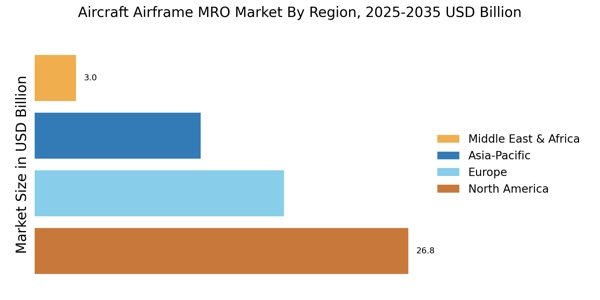

By Region: North America, Europe, Asia-Pacific, Middle East and Africa and Latin America.

9. Conclusion

The research methodology adopted by MarketResearchFuture.com for the study Aircraft Airframe MRO Market - Forecast to 2030 is based on a combination of primary and secondary research, which included interviews, surveys and the use of numerous databases. The methodology adopted was aimed at producing quality data and reliable insights into the Aircraft Airframe MRO market.