Research Methodology on Aircraft MRO Market

Introduction

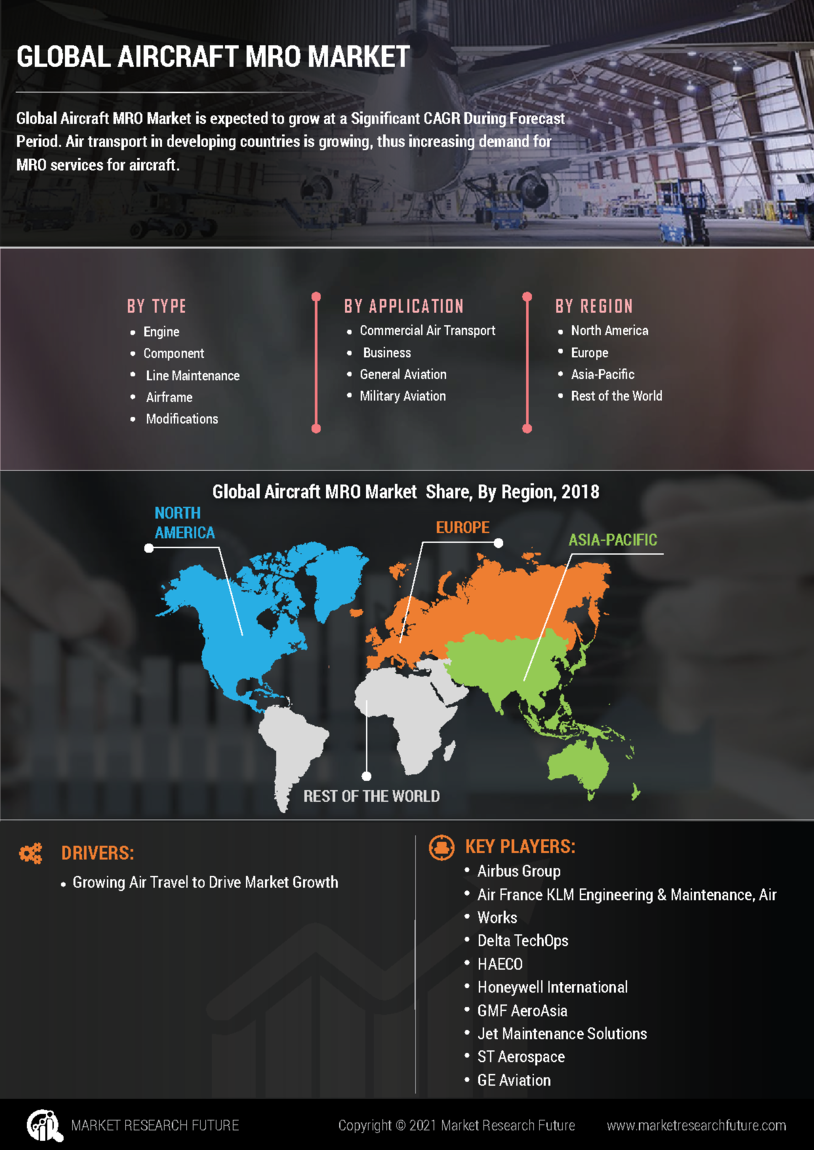

This research report on the market trends and forecast of the Aircraft MRO (Maintenance, Repair and Overhaul) market covers an in-depth analysis of the global market trends and a qualitative and quantitative analysis of the perspective of the Aircraft MRO market. The report studies the current and future perspectives of the Aircraft MRO market in the global market.

Research Scope

The scope of the research includes a comprehensive analysis of the Aircraft MRO market worldwide. The research is further divided into segments based on market type, service type, aircraft type, and geographic region. The research methodology focused on market analysis, market share analysis, industry trends and market estimations. The research is conducted using a variety of primary and secondary sources.

Research Demarcations

The research on the Aircraft MRO market is demarcated into the following segments based on market type, service type, aircraft type, and geographic region:

Market Type

- Aftermarket

- Component Manufacturing

- Maintenance

- Repair

- Overhaul

- Spare Parts & Component

Service Type

- Airframe

- Component

- Line Maintenance

- Engine

- Modification

- Aircraft Painting

- Support & Other Services

Aircraft Type

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

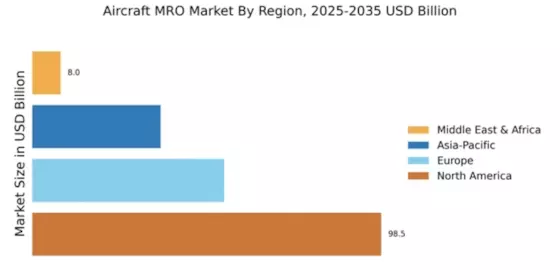

Geographic Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Research Methodology

The research methodology employed in this report includes a combination of primary and secondary research. A top-down approach is utilized to analyze the data, which involves industry experts and professionals, and meetings with key industry players. The data is collected from reliable sources such as financial reports, annual reports, press releases, and industry magazines. Additionally, a bottom-up approach is used to make sure the accuracy of data. Qualitative interviews were also conducted with industry players to determine their views and opinions on the current and estimated market situation.

In order to get the exact market size, the current trends, and growth rate estimations were made. The estimated data were made after the analysis of the current market situation. The data is then validated with the help of industry experts.

Analysis Tools

The collected data is analyzed using various analysis tools such as Porter’s Five Forces Model, market trend analysis, market estimation, and demand analysis. These tools were used to analyze and identify various aspects of the Aircraft MRO market. The analysis is used to make a forecast for the market for the next seven years.

Research Source

The research is sourced from primary and secondary sources. The primary sources include industry experts and professionals, manufacturers, financial reports, industry reports, press releases, and company visits. The secondary sources included industry publications, academic journals, and industry databases.

Conclusion

The research report on the Aircraft MRO market focuses on a comprehensive analysis of the market trends and estimations of the Aircraft MRO market in the global market. The research methodology employed in the report covers a combination of primary and secondary research sources. The data is analyzed using Porter’s Five Forces Model, market trend analysis, market estimation, and demand analysis. The collected data is further validated through interviews with industry experts. The report provides an in-depth analysis of the current and estimated market situation.