Increasing Fleet Size

The US aircraft MRO market is experiencing a notable increase in fleet size, driven by the growing demand for air travel and cargo transport. According to the Federal Aviation Administration (FAA), the number of registered aircraft in the United States has been steadily rising, with projections indicating a continued upward trend. This expansion necessitates a corresponding increase in maintenance, repair, and overhaul services to ensure safety and compliance with regulatory standards. As airlines and private operators expand their fleets, the demand for MRO services is likely to grow, creating opportunities for service providers to enhance their offerings and capabilities. The increasing fleet size not only drives revenue for MRO companies but also encourages innovation in maintenance practices and technologies, thereby shaping the future landscape of the US aircraft MRO market.

Regulatory Compliance

Regulatory compliance remains a critical driver in the US aircraft MRO market, as stringent safety standards are enforced by the FAA and other governing bodies. The need for compliance with regulations such as the Federal Aviation Regulations (FAR) ensures that MRO providers maintain high safety and quality standards in their operations. Non-compliance can lead to severe penalties, including grounding of aircraft and loss of operating licenses. Consequently, MRO providers are compelled to invest in training, quality assurance, and updated technologies to meet these regulatory requirements. This focus on compliance not only enhances safety but also fosters trust among customers, thereby driving demand for MRO services. As regulations evolve, the US aircraft MRO market must adapt, presenting both challenges and opportunities for service providers.

Focus on Sustainability

The US aircraft MRO market is increasingly prioritizing sustainability as environmental concerns gain prominence. Airlines and MRO providers are adopting eco-friendly practices to reduce their carbon footprint and comply with environmental regulations. Initiatives such as the use of sustainable aviation fuels, waste reduction programs, and energy-efficient technologies are becoming standard practices within the industry. The FAA has also introduced guidelines to promote sustainable practices among aviation stakeholders. As a result, MRO providers that embrace sustainability are likely to attract environmentally conscious customers and enhance their market position. This focus on sustainability not only addresses regulatory pressures but also aligns with the growing consumer demand for responsible business practices, thereby shaping the future of the US aircraft MRO market.

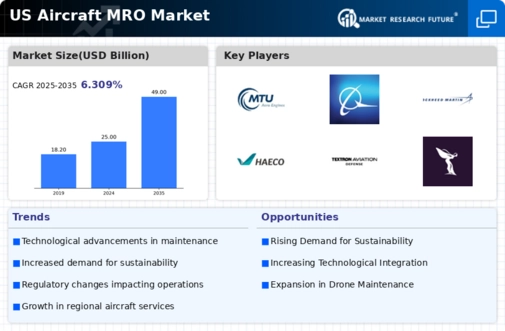

Technological Integration

The integration of advanced technologies into the US aircraft MRO market is transforming maintenance practices and operational efficiencies. Innovations such as predictive maintenance, artificial intelligence, and data analytics are being increasingly adopted by MRO providers to enhance service delivery. For instance, predictive maintenance allows for the identification of potential issues before they escalate, thereby reducing downtime and costs. The FAA has recognized the importance of these technologies, promoting initiatives that encourage their adoption across the industry. As a result, MRO providers that leverage these advancements are likely to gain a competitive edge, improving their service offerings and customer satisfaction. The ongoing technological integration is expected to reshape the operational landscape of the US aircraft MRO market, driving growth and efficiency.

Growth in Cargo Operations

The growth in cargo operations is a significant driver for the US aircraft MRO market, particularly as e-commerce continues to expand. The demand for air cargo services has surged, prompting airlines to invest in dedicated freighter aircraft and modify existing passenger planes for cargo use. This shift necessitates specialized MRO services tailored to cargo operations, including modifications, maintenance, and regulatory compliance. According to the Bureau of Transportation Statistics, air cargo traffic has seen substantial increases, indicating a robust market for MRO services catering to this segment. As cargo operations grow, MRO providers that can adapt to the unique requirements of cargo aircraft are likely to thrive, further propelling the growth of the US aircraft MRO market.