Research Methodology on Allergy Immunotherapy Market

Introduction:

Allergy immunotherapy is a medical treatment that is used to treat an allergic response to particular substances, such as pollen, dust mites, or animal dander. The goal of immunotherapy is to decrease the patient's sensitization to the allergen, thus decreasing the severity and frequency of the allergic reactions. This type of treatment is usually administered at regular intervals, and the exact timeline depends on the individual patient's condition. It can take up to three years for a patient to see significant improvement in their symptoms. Furthermore, allergy immunotherapy is often used as a long-term solution for individuals who have difficulty controlling their allergies with other treatment methods or medications.

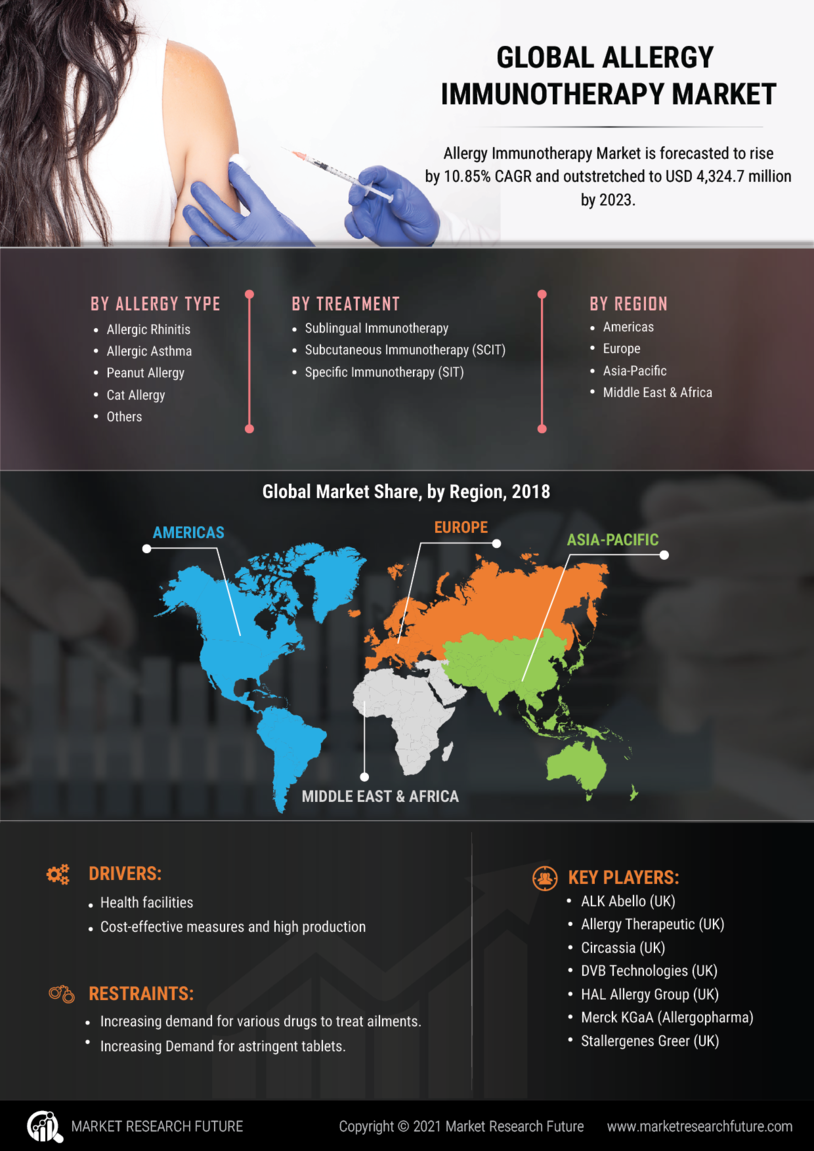

The growing prevalence of allergies worldwide and the increasing use of allergy immunotherapy products are some of the major factors driving the growth of the market. Furthermore, the launch of new and improved products and the availability of extensive reimbursement plans are also expected to drive the market further over the forecast period 2023 to 2030.

In this market research report, the global allergy immunotherapy market is segmented based on product type, route of administration, end-user, and region. The product type segment is further sub-segmented into sublingual immunotherapy, subcutaneous immunotherapy, and others. The route of administration segment is further sub-segmented into subcutaneous and oral. Additionally, the end-user segment is further categorized into hospitals, speciality clinics, and others.

Research Methodology:

The objective of this market research report is to study the global allergy immunotherapy market during the forecast period from 2023 to 2030. To understand the market dynamics, market trends, and other factors affecting the global allergy immunotherapy market, a comprehensive research methodology is followed. This study is conducted to analyze the market size in terms of value (USD Million). A systematic approach is followed, where the global allergy immunotherapy market is first segmented into several sub-segments and the related market dynamics were studied.

The research methodology involves primary and secondary data collection and analysis. Data is collected from the major key players operating in the global allergy immunotherapy market. The primary data sources include interviews and discussions with experts from manufacturers, suppliers, distributors, and end-user organizations operating in the global allergy immunotherapy market. The secondary data sources include various sources such as company websites, industry associations, and published reports. Additionally, a SWOT analysis is conducted to identify the strengths, weaknesses, opportunities, and threats that are associated with the global allergy immunotherapy market.

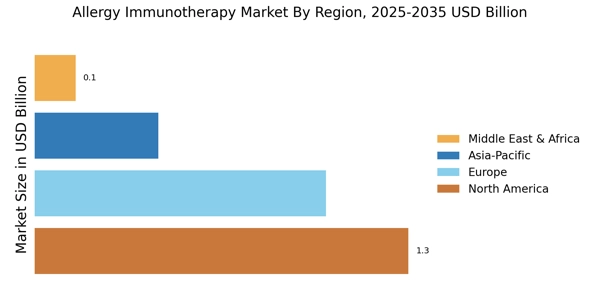

To estimate the global allergy immunotherapy market size and market shares, the market is segmented into various categories. The market size is estimated using bottom-up and top-down approaches, whereas the historical and current market data are used to analyze the market trends. Market estimations and forecasts are developed on a regional, sub-regional, and country-level basis.

The bottom-up approach is used to derive the global allergy immunotherapy market size by estimating the sales volume of each product type based on the revenue of key players operating in the market. Furthermore, the market is studied in terms of various routes of administration and end-users. Market estimations and forecasts were made for each segment based on sales or volume during the forecast period from 2023 to 2030. The data collected from primary and secondary sources is validated and verified by analyzing the views of various industry experts operating in the global allergy immunotherapy market.

Finally, market estimates and forecasts were validated through the triangulation method, where secondary and primary research data sets were compared with third-party data sets, such as technology blogs, industry associations, and news articles. This research methodology enables us to gather data and analyze trends across a wide range of factors and segments, including product type, route of administration, end-user, and region. The final data sets, once validated and verified, were used to develop the report and develop market estimates and forecasts.