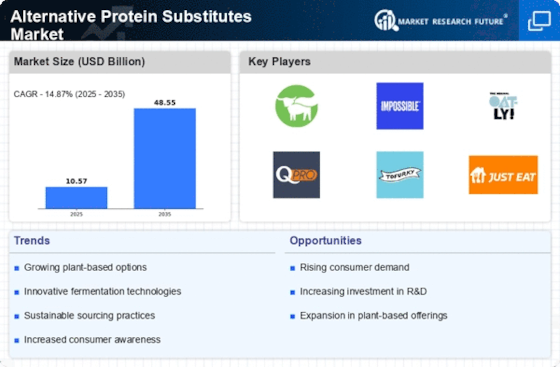

The Alternative Protein Substitutes Market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for sustainable and health-conscious food options. Major players such as Beyond Meat (US), Impossible Foods (US), and Oatly (SE) are at the forefront, each adopting distinct strategies to enhance their market presence. Beyond Meat (US) focuses on innovation in product development, particularly in expanding its portfolio to include new meat alternatives that appeal to a broader demographic. Meanwhile, Impossible Foods (US) emphasizes partnerships with food service providers to increase accessibility and visibility of its products. Oatly (SE), on the other hand, is leveraging its strong brand identity in the dairy alternative segment to penetrate new markets, particularly in Asia, where demand for plant-based options is surging. Collectively, these strategies contribute to a competitive environment that is increasingly centered around innovation and market expansion.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce supply chain vulnerabilities and enhance responsiveness to regional market demands. This approach appears to be particularly effective in a moderately fragmented market structure, where the collective influence of key players shapes consumer preferences and market trends. The focus on optimizing supply chains is evident as companies strive to maintain competitive pricing while ensuring product quality and sustainability.

In August 2025, Beyond Meat (US) announced a strategic partnership with a major fast-food chain to introduce a new line of plant-based burgers. This collaboration is significant as it not only enhances Beyond Meat's visibility but also positions the company to capture a larger share of the fast-food market, which is increasingly leaning towards plant-based options. The partnership is expected to drive sales and reinforce the brand's commitment to making plant-based diets more accessible.

In September 2025, Impossible Foods (US) launched a new product line aimed at the retail sector, featuring ready-to-cook meal kits that incorporate its plant-based meat. This move is indicative of the company's strategy to diversify its offerings and cater to the growing trend of home cooking. By providing convenient meal solutions, Impossible Foods (US) is likely to attract a wider consumer base, particularly among those seeking quick and healthy meal options.

In July 2025, Oatly (SE) expanded its operations into the Asian market by opening a new production facility in China. This strategic move is crucial as it allows Oatly to meet the rising demand for dairy alternatives in a region that is increasingly adopting plant-based diets. The facility is expected to enhance supply chain efficiency and reduce costs, thereby positioning Oatly favorably against competitors in the rapidly growing Asian market.

As of October 2025, the competitive trends in the Alternative Protein Substitutes Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in product development and supply chain management. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing innovation and market reach. Looking ahead, it is anticipated that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the evolving landscape.

Leave a Comment