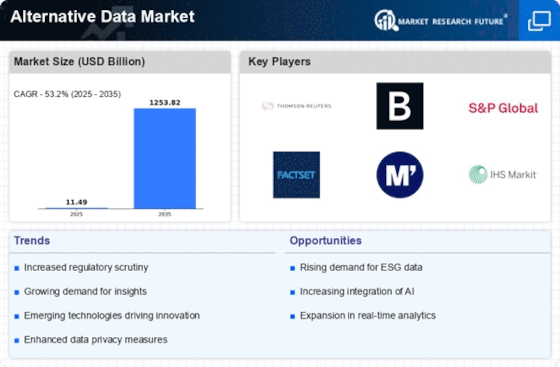

The Alternative Data Market is currently experiencing a transformative phase, driven by the increasing demand for innovative data sources that provide insights beyond traditional metrics. Organizations across various sectors are recognizing the value of alternative data in enhancing decision-making processes, improving operational efficiency, and gaining competitive advantages. This market encompasses a diverse range of data types, including social media sentiment, satellite imagery, and transaction data, which are utilized to inform investment strategies, risk assessments, and market predictions. As businesses continue to seek out unique data sets, the landscape of the Alternative Data Market is evolving rapidly, with new players entering the field and existing firms expanding their offerings. Moreover, the integration of advanced technologies such as artificial intelligence and machine learning is further propelling the growth of the Alternative Data Market. These technologies enable organizations to analyze vast amounts of data more effectively, uncovering patterns and trends that were previously difficult to detect. As the market matures, regulatory considerations and ethical implications surrounding data usage are becoming increasingly prominent. Stakeholders are urged to navigate these complexities carefully, ensuring compliance while maximizing the potential of alternative data. The future of the Alternative Data Market appears promising, with ongoing innovations likely to reshape how data is collected, analyzed, and applied across industries.

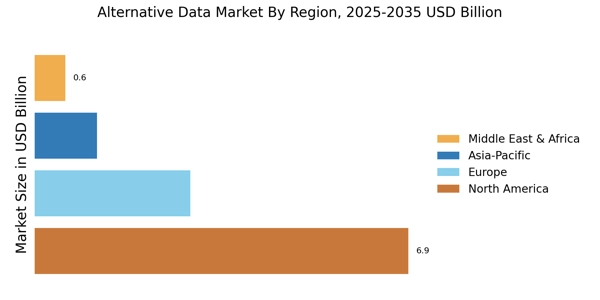

The alternative data market size reflects strong market size growth, supported by rising demand for data-driven insights across multiple industry verticals. The alternative data market is expanding rapidly as organizations increasingly rely on alternative data sources to complement traditional datasets and improve decision-making accuracy. The growing adoption of diverse alternative data sets is reshaping the global alternative data industry, particularly across financial services and enterprise analytics. The evolution of the alternative data market is driven by innovation in alternative data analysis, enabling organizations to extract value from complex and unstructured data. Machine learning tools are accelerating alternative data research, allowing enterprises and investors to interpret large-scale alternative data sets more efficiently. Regulatory compliance is increasingly shaping the alternative market, as organizations ensure responsible usage of alternative data sources. Segmentation by type highlights the breadth of alternative data sources fueling growth across the alternative data market. Investment research remains the dominant application, as alternative data for investors supports portfolio optimization and risk-adjusted returns, accelerating the trend of alternative data investing. The increasing reliance on publicly available and user-generated alternative data sets underscores the importance of scalable alternative data providers in the global market. Overall, the alternative data market size is expected to witness sustained expansion, supported by strong market size and growth rate, technological innovation, and expanding enterprise adoption.

Increased Adoption of Machine Learning

The integration of machine learning technologies is becoming more prevalent within the Alternative Data Market. Organizations are leveraging these advanced algorithms to process and analyze large datasets, enabling them to extract actionable insights more efficiently. This trend suggests a shift towards data-driven decision-making, where predictive analytics play a crucial role in shaping business strategies.

Focus on Data Privacy and Compliance

As the Alternative Data Market expands, there is a growing emphasis on data privacy and regulatory compliance. Companies are increasingly aware of the need to adhere to legal frameworks governing data usage. This trend indicates a potential shift towards more transparent data practices, fostering trust among consumers and stakeholders.

Diversification of Data Sources

The Alternative Data Market is witnessing a diversification of data sources, with organizations exploring unconventional datasets to gain a competitive edge. This trend highlights the importance of integrating various data types, such as geolocation data and web scraping, to enhance analytical capabilities and improve market predictions.