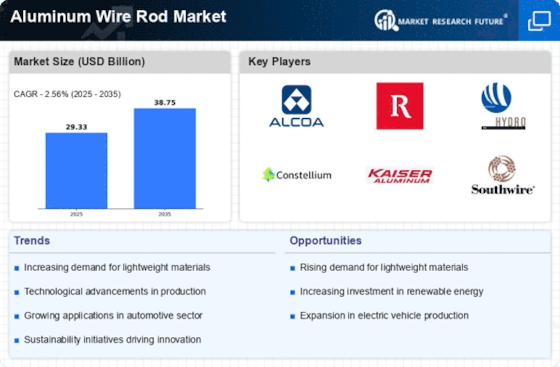

Rising Demand from Automotive Sector

The automotive sector is experiencing a notable increase in demand for lightweight materials, particularly aluminum wire rods. This trend is driven by the industry's focus on enhancing fuel efficiency and reducing emissions. In 2025, the automotive industry is projected to account for approximately 30% of the total aluminum wire rod consumption. The Aluminum Wire Rod Market is likely to benefit from this shift, as manufacturers seek to replace heavier materials with aluminum. Furthermore, the growing trend of electric vehicles, which require extensive wiring and lightweight components, is expected to further bolster demand. As automakers increasingly prioritize sustainability and performance, the aluminum wire rod market is poised for significant growth.

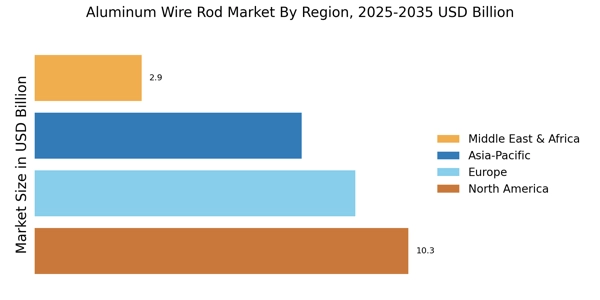

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are contributing to the expansion of the Aluminum Wire Rod Market. Governments are investing heavily in infrastructure projects, including transportation, energy, and telecommunications. In 2025, it is estimated that infrastructure spending will reach unprecedented levels, with a substantial portion allocated to projects utilizing aluminum wire rods. These materials are favored for their durability, conductivity, and resistance to corrosion, making them ideal for electrical wiring and structural applications. As countries strive to modernize their infrastructure, the demand for aluminum wire rods is expected to rise, creating opportunities for manufacturers and suppliers in the market.

Sustainability and Recycling Initiatives

Sustainability and recycling initiatives are becoming increasingly important in the Aluminum Wire Rod Market. The emphasis on reducing carbon footprints and promoting circular economies is driving the demand for recycled aluminum wire rods. In 2025, it is anticipated that recycled aluminum will account for a significant share of the market, as manufacturers seek to meet sustainability goals. The lightweight nature of aluminum, combined with its recyclability, positions it as a favorable material in various applications. As industries prioritize sustainable practices, the aluminum wire rod market is expected to benefit from the growing preference for eco-friendly materials, leading to increased production and consumption.

Growing Electrical and Electronics Sector

The electrical and electronics sector is a significant driver of the Aluminum Wire Rod Market. With the increasing demand for electrical wiring and components, the consumption of aluminum wire rods is expected to rise substantially. In 2025, the electrical and electronics industry is projected to account for around 25% of the total aluminum wire rod market. The lightweight and conductive properties of aluminum make it a preferred choice for manufacturers of electrical products. As the demand for consumer electronics, renewable energy systems, and smart technologies continues to grow, the aluminum wire rod market is likely to experience robust growth, driven by the needs of this sector.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the Aluminum Wire Rod Market. Advances in production techniques, such as continuous casting and extrusion, have enhanced the efficiency and quality of aluminum wire rods. These innovations allow for the production of rods with superior mechanical properties and reduced production costs. In 2025, the market is likely to witness a surge in the adoption of automated manufacturing systems, which can increase output and minimize waste. As manufacturers embrace these technologies, they can meet the growing demand for high-performance aluminum wire rods across various applications, including construction and electrical industries.