Technological Innovations

Technological advancements in steel production and processing are transforming the Steel Wire Rod Market. Innovations such as improved casting techniques, enhanced rolling processes, and advanced heat treatment methods are leading to the production of higher quality steel wire rods. These innovations not only improve the mechanical properties of the rods but also increase production efficiency. For instance, the introduction of automation and digitalization in manufacturing processes is expected to reduce costs and enhance product consistency. As these technologies become more prevalent, they may drive the demand for steel wire rods, as manufacturers seek to leverage these advancements to meet evolving market needs.

Automotive Industry Growth

The resurgence of the automotive industry is likely to bolster the Steel Wire Rod Market significantly. As vehicle production ramps up, the demand for high-strength steel wire rods, which are essential for manufacturing components such as springs, cables, and tires, is expected to rise. Recent statistics suggest that the automotive sector accounts for nearly 30% of the total steel consumption, with wire rods being a crucial input. Furthermore, the shift towards electric vehicles may also influence the market, as these vehicles require specialized steel components. This evolving landscape indicates a promising outlook for steel wire rods, driven by the automotive industry's growth.

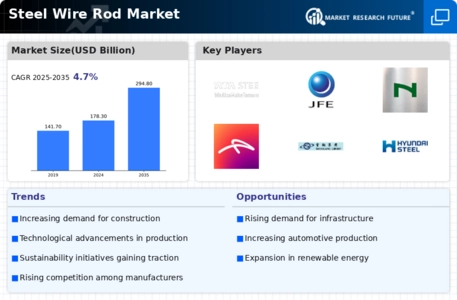

Infrastructure Development

The ongoing expansion of infrastructure projects worldwide appears to be a primary driver for the Steel Wire Rod Market. Governments and private sectors are investing heavily in construction, transportation, and energy sectors, which require substantial amounts of steel wire rods. For instance, the construction of bridges, highways, and railways necessitates high-quality steel wire rods for reinforcement and support. According to recent data, the demand for steel wire rods in construction is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This trend indicates a robust market for steel wire rods, as infrastructure development continues to gain momentum across various regions.

Rising Demand in Manufacturing

The manufacturing sector's increasing reliance on steel wire rods is a notable driver for the Steel Wire Rod Market. Industries such as machinery, appliances, and construction equipment utilize steel wire rods for various applications, including fasteners and structural components. Recent data indicates that the manufacturing sector's demand for steel wire rods is projected to grow by approximately 3.8% annually. This growth is attributed to the ongoing industrialization in emerging markets, where manufacturing activities are expanding rapidly. As manufacturers seek to enhance product quality and performance, the demand for high-grade steel wire rods is likely to rise, further propelling the market.

Sustainability and Recycling Initiatives

The growing emphasis on sustainability and recycling within the Steel Wire Rod Market is becoming increasingly influential. As environmental concerns rise, industries are seeking to reduce their carbon footprint and enhance resource efficiency. The steel industry, in particular, is focusing on recycling scrap steel to produce wire rods, which not only conserves resources but also reduces energy consumption. Recent reports indicate that recycled steel can reduce greenhouse gas emissions by up to 75% compared to traditional methods. This shift towards sustainable practices is likely to create new opportunities for the steel wire rod market, as companies strive to align with global sustainability goals.

Leave a Comment