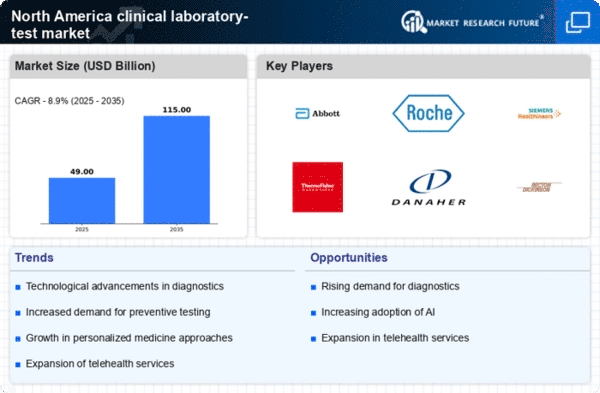

Integration of Advanced Technologies

The integration of advanced technologies into the clinical laboratory-test market is transforming testing processes. Innovations such as artificial intelligence (AI), machine learning, and automation are streamlining laboratory operations, improving accuracy, and reducing turnaround times. For instance, AI algorithms can analyze complex data sets, leading to more precise results. The market for laboratory automation is expected to grow significantly, with estimates suggesting a value of $XX billion by 2025. This technological evolution not only enhances efficiency but also supports laboratories in managing increased test volumes, thereby driving growth in the clinical laboratory-test market.

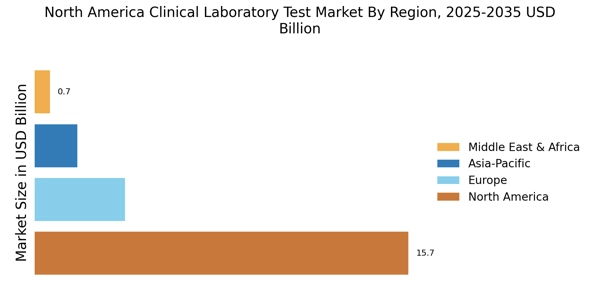

Rising Demand for Diagnostic Testing

The clinical laboratory-test market in North America experiences a notable increase in demand for diagnostic testing. This surge is driven by a growing awareness of health issues and the need for early detection of diseases. According to recent data, the market is projected to reach approximately $XX billion by 2026, reflecting a CAGR of around XX%. This trend is further fueled by the aging population, which is more susceptible to chronic diseases requiring regular monitoring. As healthcare providers emphasize the importance of timely diagnosis, the clinical laboratory-test market is likely to expand, accommodating the rising volume of tests and enhancing laboratory capabilities to meet patient needs.

Rising Prevalence of Chronic Diseases

The clinical laboratory-test market is significantly impacted by the rising prevalence of chronic diseases in North America. Conditions such as diabetes, cardiovascular diseases, and cancer require ongoing monitoring and diagnostic testing. Data indicates that chronic diseases account for approximately 70% of all deaths in the region, highlighting the urgent need for effective testing solutions. As healthcare systems prioritize the management of these conditions, the demand for laboratory tests is expected to grow. This trend is likely to drive innovation and expansion within the clinical laboratory-test market, as laboratories adapt to meet the needs of patients with chronic illnesses.

Increased Focus on Personalized Medicine

The clinical laboratory-test market is witnessing a shift towards personalized medicine, which tailors treatment based on individual patient characteristics. This approach necessitates advanced testing methods to identify specific biomarkers and genetic profiles. As healthcare providers adopt personalized treatment plans, the demand for specialized laboratory tests is likely to rise. Reports indicate that the personalized medicine market could reach $XX billion by 2027, with a substantial portion attributed to laboratory testing. This trend underscores the importance of precision diagnostics in improving patient outcomes and is expected to significantly influence the clinical laboratory-test market.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a critical driver for the clinical laboratory-test market in North America. Governments and private entities are increasingly allocating funds to enhance laboratory facilities, expand testing capabilities, and improve access to diagnostic services. Recent initiatives have led to the establishment of state-of-the-art laboratories equipped with advanced technologies. This investment is projected to boost the clinical laboratory-test market, with estimates suggesting a growth rate of XX% over the next few years. Enhanced infrastructure not only supports the rising demand for tests but also ensures that laboratories can maintain high standards of quality and efficiency.