Rising Incidence of Orthopedic Disorders

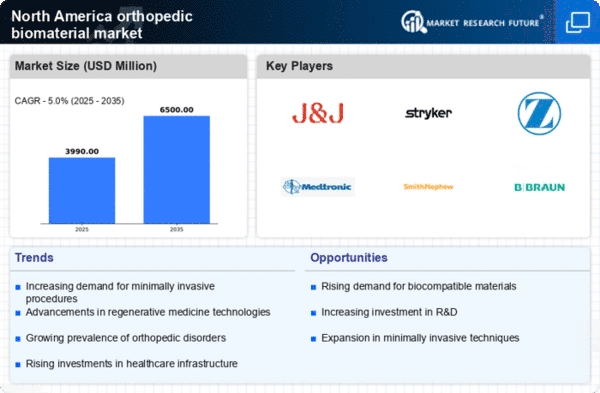

The orthopedic biomaterial market in North America is experiencing growth due to the rising incidence of orthopedic disorders. Conditions such as osteoarthritis, fractures, and sports injuries are becoming increasingly prevalent, leading to a higher demand for orthopedic interventions. According to recent data, approximately 30 million adults in the U.S. are affected by osteoarthritis, which necessitates the use of advanced biomaterials for joint replacements and other surgical procedures. This trend indicates a robust market potential for orthopedic biomaterials, as healthcare providers seek innovative solutions to address these challenges. The increasing aging population further exacerbates this issue, as older adults are more susceptible to orthopedic conditions. Consequently, the orthopedic biomaterial market is poised for expansion as it adapts to meet the needs of a growing patient demographic.

Technological Innovations in Biomaterials

Technological advancements are significantly influencing the orthopedic biomaterial market in North America. Innovations in material science, such as the development of bioactive ceramics and advanced polymers, are enhancing the performance and longevity of orthopedic implants. These materials are designed to promote better integration with bone tissue, thereby improving patient outcomes. Furthermore, the incorporation of smart technologies, such as sensors embedded in implants, is gaining traction. These sensors can monitor the healing process and provide real-time data to healthcare providers. The market for orthopedic biomaterials is projected to reach approximately $15 billion by 2026, driven by these technological innovations. As a result, the orthopedic biomaterial market is likely to witness a surge in demand for cutting-edge products that offer improved functionality and patient satisfaction.

Regulatory Support for Advanced Biomaterials

Regulatory support plays a pivotal role in shaping the orthopedic biomaterial market in North America. Agencies such as the Food and Drug Administration (FDA) are actively promoting the approval of innovative biomaterials that meet safety and efficacy standards. Recent initiatives aimed at streamlining the approval process for new orthopedic devices have encouraged manufacturers to invest in the development of advanced biomaterials. This regulatory environment fosters innovation and enhances market competitiveness. For instance, the FDA's Breakthrough Devices Program expedites the review of devices that offer significant advantages over existing options. As a result, the orthopedic biomaterial market is likely to benefit from a more favorable regulatory landscape, which could lead to the introduction of groundbreaking products that improve patient care and surgical outcomes.

Growing Demand for Minimally Invasive Procedures

The orthopedic biomaterial market is witnessing a growing demand for minimally invasive surgical procedures. These techniques offer numerous advantages, including reduced recovery times, less postoperative pain, and lower risk of complications. As a result, there is an increasing need for specialized biomaterials that can facilitate these procedures. For example, the use of injectable biomaterials for bone repair and regeneration is gaining popularity. The market for minimally invasive orthopedic surgeries is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates a shift in surgical practices, prompting manufacturers to develop biomaterials that cater specifically to the requirements of minimally invasive techniques. Consequently, the orthopedic biomaterial market is likely to expand as it aligns with this evolving surgical landscape.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the orthopedic biomaterial market in North America. Companies are allocating substantial resources to explore new biomaterials and improve existing ones. This focus on R&D is essential for addressing the evolving needs of patients and healthcare providers. For instance, the National Institutes of Health (NIH) has reported funding exceeding $1 billion for orthopedic research initiatives, which underscores the commitment to advancing biomaterial technologies. This influx of funding is likely to accelerate the development of innovative solutions, such as biodegradable implants and enhanced surface coatings that promote osseointegration. As a result, the orthopedic biomaterial market is expected to benefit from a continuous stream of novel products that enhance surgical outcomes and patient recovery.