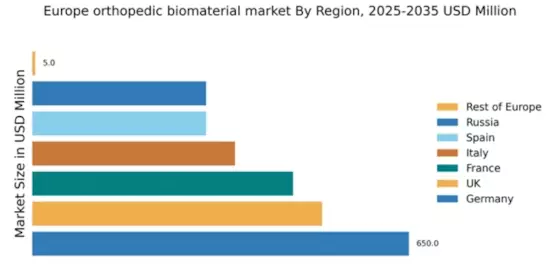

Germany : Strong Demand and Innovation Drive Growth

Key markets within Germany include major cities like Berlin, Munich, and Frankfurt, which host numerous healthcare facilities and research institutions. The competitive landscape is robust, featuring major players such as Aesculap and Stryker, alongside international firms like DePuy Synthes. Local dynamics are characterized by a strong emphasis on quality and compliance, with applications spanning joint replacements, spinal surgery, and trauma care, ensuring a vibrant business environment.

UK : Innovative Solutions and Aging Population

Key markets include London, Manchester, and Birmingham, where healthcare facilities are increasingly adopting innovative orthopedic solutions. The competitive landscape features significant players like Smith & Nephew and Zimmer Biomet, alongside emerging local firms. The UK market is characterized by a focus on patient-centered care, with applications in joint reconstruction, sports medicine, and trauma management, enhancing the overall business climate.

France : Strong Demand and Regulatory Support

Key markets in France include Paris, Lyon, and Marseille, where advanced healthcare facilities are adopting new technologies. The competitive landscape is marked by the presence of major players like Medtronic and Stryker, alongside local companies. The market dynamics emphasize collaboration between public and private sectors, with applications in orthopedic surgery, trauma care, and rehabilitation, creating a vibrant business environment.

Russia : Increasing Demand and Investment Opportunities

Key markets include Moscow and St. Petersburg, where healthcare facilities are increasingly adopting innovative orthopedic solutions. The competitive landscape features both local and international players, with companies like Orthofix gaining traction. Local market dynamics are characterized by a focus on affordability and accessibility, with applications in joint replacement and trauma care, enhancing the overall business environment.

Italy : Healthcare Investments Drive Market Expansion

Key markets in Italy include Rome, Milan, and Naples, where healthcare facilities are adopting innovative orthopedic solutions. The competitive landscape features major players like DePuy Synthes and Medtronic, alongside local firms. The market dynamics emphasize collaboration between public and private sectors, with applications in joint reconstruction and trauma care, creating a favorable business environment.

Spain : Investment in Healthcare Infrastructure

Key markets include Madrid and Barcelona, where healthcare facilities are increasingly adopting innovative orthopedic solutions. The competitive landscape features both local and international players, with companies like Stryker and Smith & Nephew gaining traction. Local market dynamics are characterized by a focus on affordability and accessibility, with applications in joint replacement and trauma care, enhancing the overall business environment.

Rest of Europe : Diverse Needs and Local Solutions

Key markets include smaller nations with specific healthcare needs, where local firms are addressing unique challenges. The competitive landscape is fragmented, with various small players and regional firms. Local dynamics emphasize tailored solutions for specific applications, including trauma care and rehabilitation, creating unique business opportunities.