Increased Focus on Soil Health

The growing awareness of soil health and its impact on crop productivity is a significant driver for the Amino Acid For Agriculture Market. Healthy soil is essential for sustainable agriculture, and amino acids contribute to soil fertility by promoting microbial activity and nutrient availability. Recent studies indicate that amino acid-based fertilizers can enhance soil structure and nutrient retention, leading to improved crop yields. As farmers increasingly prioritize soil health, the demand for amino acid products is likely to rise, further stimulating the Amino Acid For Agriculture Market. This focus on sustainable practices aligns with broader agricultural trends aimed at long-term productivity.

Rising Demand for Organic Produce

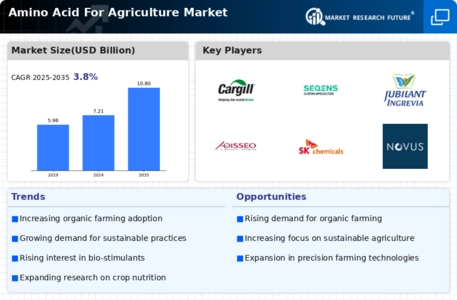

The increasing consumer preference for organic produce is a pivotal driver for the Amino Acid For Agriculture Market. As consumers become more health-conscious, the demand for organic fruits and vegetables has surged. This trend is reflected in market data, indicating that organic food sales have grown significantly, with projections suggesting a continued upward trajectory. Amino acids play a crucial role in organic farming by enhancing plant growth and improving nutrient uptake. Consequently, farmers are increasingly adopting amino acid-based fertilizers to meet the rising demand for organic produce, thereby propelling the Amino Acid For Agriculture Market forward.

Advancements in Agricultural Technology

Technological advancements in agriculture are transforming farming practices, thereby influencing the Amino Acid For Agriculture Market. Innovations such as precision farming and biotechnology are enabling farmers to optimize their crop yields and resource utilization. For instance, the integration of amino acids in fertilizers has been shown to enhance plant resilience against environmental stressors. Market data indicates that the adoption of such technologies is on the rise, with many farmers recognizing the benefits of amino acid applications. This trend suggests a promising future for the Amino Acid For Agriculture Market as technology continues to evolve and improve agricultural efficiency.

Growing Awareness of Nutritional Benefits

The increasing awareness of the nutritional benefits of amino acids in agriculture is driving the Amino Acid For Agriculture Market. Farmers and agronomists are recognizing that amino acids not only enhance plant growth but also improve the nutritional quality of crops. This awareness is supported by research indicating that amino acid applications can lead to higher protein content in crops, which is particularly important for food security. As the demand for nutrient-rich food continues to rise, the Amino Acid For Agriculture Market is likely to experience growth, as more farmers adopt amino acid-based solutions to enhance crop quality.

Regulatory Support for Sustainable Practices

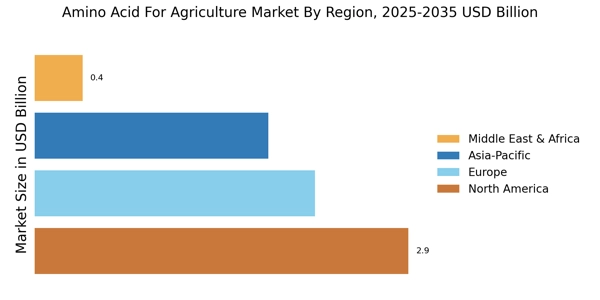

Regulatory frameworks promoting sustainable agricultural practices are influencing the Amino Acid For Agriculture Market. Governments worldwide are implementing policies that encourage the use of environmentally friendly fertilizers, including those based on amino acids. These regulations aim to reduce chemical runoff and promote sustainable farming methods. Market data suggests that regions with stringent environmental regulations are witnessing a shift towards amino acid-based fertilizers, as they align with sustainability goals. This regulatory support is likely to bolster the Amino Acid For Agriculture Market, as farmers seek compliant and effective solutions to enhance crop production.

Leave a Comment