Rising Demand in Electronics

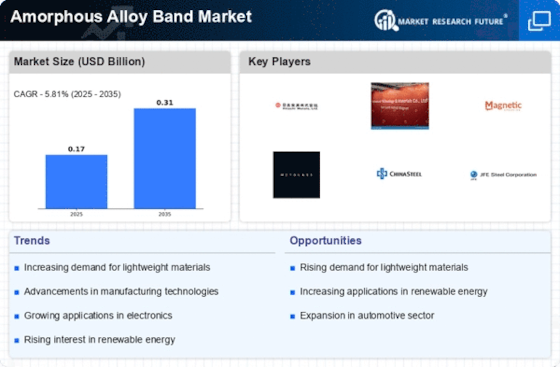

The Amorphous Alloy Band Market is witnessing a notable increase in demand from the electronics sector. Amorphous alloys are prized for their unique magnetic properties, which make them ideal for use in transformers, inductors, and other electronic components. The Amorphous Alloy Band Market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This growth is expected to drive the demand for amorphous alloy bands, as manufacturers seek materials that enhance energy efficiency and performance. Furthermore, the trend towards miniaturization in electronics is likely to further propel the adoption of amorphous alloys, as they offer superior performance in compact designs. Consequently, the Amorphous Alloy Band Market stands to benefit from this rising demand.

Increased Focus on Energy Efficiency

The Amorphous Alloy Band Market is increasingly influenced by a global emphasis on energy efficiency. As industries strive to reduce energy consumption and carbon footprints, amorphous alloys are emerging as a viable solution due to their superior magnetic properties. These materials exhibit lower energy losses compared to traditional crystalline alloys, making them ideal for applications in energy-efficient transformers and motors. The push for sustainable energy solutions is likely to drive investments in the Amorphous Alloy Band Market, as companies seek to comply with stringent regulations and meet consumer demand for greener products. This trend is expected to foster innovation and development within the industry, as manufacturers explore new applications and improve existing technologies.

Technological Innovations in Manufacturing

The Amorphous Alloy Band Market is experiencing a surge in technological innovations that enhance manufacturing processes. Advanced techniques such as rapid solidification and precision casting are being adopted, which improve the quality and performance of amorphous alloys. These innovations not only reduce production costs but also increase the efficiency of the manufacturing process. As a result, manufacturers are able to produce high-quality amorphous alloy bands at a lower price point, making them more accessible to various industries. The integration of automation and smart manufacturing technologies further streamlines production, allowing for greater scalability. This trend is likely to drive growth in the Amorphous Alloy Band Market, as companies seek to leverage these advancements to gain a competitive edge.

Expanding Applications in Automotive Sector

The Amorphous Alloy Band Market is poised for growth due to expanding applications in the automotive sector. As the automotive industry increasingly adopts advanced materials to enhance vehicle performance and efficiency, amorphous alloys are gaining traction. These materials are utilized in electric vehicle components, such as motors and transformers, where their lightweight and high-performance characteristics are advantageous. The automotive sector is undergoing a transformation towards electrification, with projections indicating that electric vehicle sales could reach 30% of total vehicle sales by 2030. This shift is likely to create substantial opportunities for the Amorphous Alloy Band Market, as manufacturers seek to incorporate innovative materials that contribute to improved energy efficiency and reduced emissions.

Growing Investment in Research and Development

The Amorphous Alloy Band Market is benefiting from a growing investment in research and development. As companies recognize the potential of amorphous alloys in various applications, there is an increasing focus on R&D to explore new formulations and processing techniques. This investment is likely to lead to the discovery of novel applications and improvements in existing products, thereby expanding the market. Government initiatives and funding for advanced materials research are also contributing to this trend, as policymakers aim to foster innovation and competitiveness. The emphasis on developing high-performance materials is expected to drive advancements in the Amorphous Alloy Band Market, positioning it for sustained growth in the coming years.