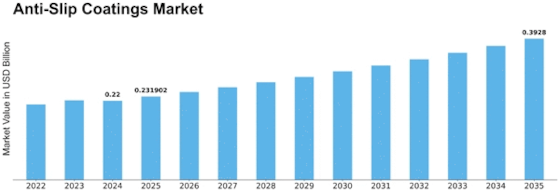

Anti Slip Coatings Size

Anti-Slip Coatings Market Growth Projections and Opportunities

The anti-slip coatings market is influenced by various market factors that play a crucial role in its growth and dynamics. One of the primary factors is the increasing awareness regarding safety measures across industries. As businesses strive to enhance workplace safety and reduce the risk of accidents, the demand for anti-slip coatings rises. Industries such as manufacturing, healthcare, hospitality, and transportation are particularly sensitive to safety concerns, driving the adoption of anti-slip solutions.

Anti-slip coatings help in saving lives; and look after the safety of employees. It contains additives of aluminum oxide, carborundum, and sand. It is primarily designed to prevent slips and maintain surface shine and luster for long time. These coatings are glossy and are available in different colors.

Moreover, stringent regulations and standards regarding workplace safety further propel the demand for anti-slip coatings. Government bodies and regulatory agencies impose strict guidelines to ensure the safety of workers and visitors in commercial and industrial settings. Compliance with these regulations necessitates the implementation of anti-slip measures, driving market growth.

Additionally, the growth of the construction industry significantly impacts the anti-slip coatings market. As construction activities increase globally, there is a parallel rise in the demand for materials and solutions that enhance the safety and durability of infrastructure. Anti-slip coatings find extensive applications in construction projects, ranging from residential buildings to bridges and highways, further fueling market expansion.

Furthermore, the growing emphasis on sustainability and environmental consciousness influences market trends. Manufacturers are increasingly developing eco-friendly and non-toxic anti-slip coatings to align with sustainability goals and meet consumer preferences. This shift towards green solutions not only addresses environmental concerns but also enhances the market appeal of anti-slip coatings.

Moreover, technological advancements play a crucial role in shaping the market landscape. Innovations in materials science and manufacturing processes lead to the development of advanced anti-slip coatings with improved durability, performance, and aesthetic appeal. These technological developments attract consumers looking for high-quality solutions, driving market growth and competitiveness.

The economic landscape also influences the anti-slip coatings market. Economic growth, industrial development, and infrastructure investments in emerging economies contribute to market expansion by creating demand for safety solutions in various sectors. Conversely, economic downturns and market uncertainties may temporarily slow down market growth as businesses prioritize cost-cutting measures.

Furthermore, demographic trends and lifestyle changes impact the demand for anti-slip coatings. An aging population, particularly in developed regions, increases the focus on products and solutions that cater to elderly individuals' safety needs. Similarly, the rise of leisure and recreational facilities fosters demand for anti-slip coatings in public spaces such as swimming pools, gyms, and amusement parks.

Moreover, competitive dynamics and industry structure play a significant role in shaping market trends. The presence of numerous manufacturers and suppliers competing for market share leads to product innovation, competitive pricing strategies, and market consolidation through mergers and acquisitions. These factors influence product availability, pricing, and overall market dynamics.

Leave a Comment