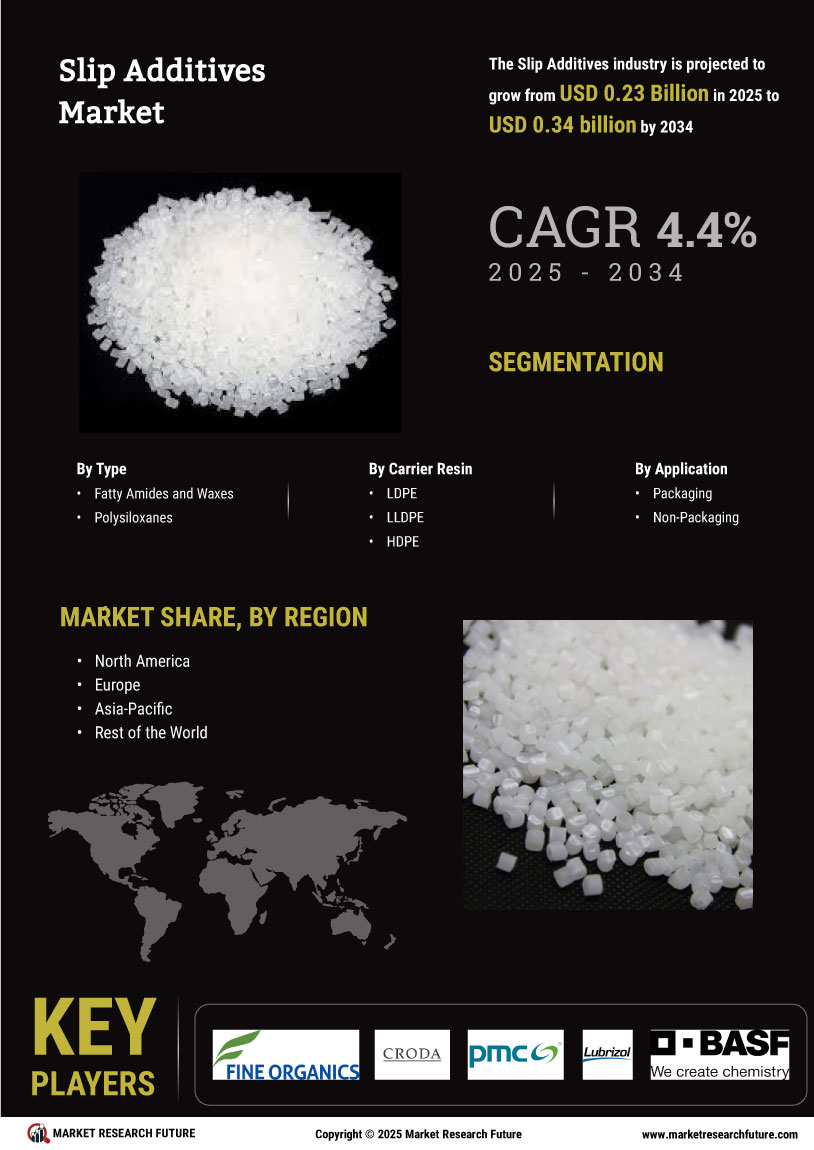

The Slip Additives Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for high-performance materials across various industries, including packaging, automotive, and consumer goods. Key players such as BASF SE (DE), Evonik Industries AG (DE), and Honeywell International Inc. (US) are strategically positioned to leverage innovation and sustainability as core components of their operational focus. These companies are actively investing in research and development to enhance product performance and reduce environmental impact, thereby shaping a competitive environment that prioritizes both efficiency and ecological responsibility.In terms of business tactics, companies are increasingly localizing manufacturing to optimize supply chains and reduce lead times. The market appears moderately fragmented, with several players vying for market share while also collaborating through strategic partnerships. This collective influence of key players fosters a competitive structure that encourages innovation and responsiveness to market demands, ultimately benefiting end-users through improved product offerings.

In November BASF SE (DE) announced the launch of a new line of bio-based slip additives aimed at reducing the carbon footprint of plastic products. This strategic move not only aligns with global sustainability trends but also positions BASF as a leader in eco-friendly solutions within the Slip Additives Market. The introduction of these products is expected to enhance BASF's competitive edge by appealing to environmentally conscious consumers and businesses.Similarly, in October 2025, Evonik Industries AG (DE) expanded its production capacity for slip additives in response to rising demand in the Asia-Pacific region. This expansion reflects Evonik's commitment to regional growth and its strategy to capitalize on emerging markets. By increasing its manufacturing capabilities, Evonik is likely to strengthen its market position and improve supply chain efficiency, thereby enhancing customer satisfaction.

In September Honeywell International Inc. (US) entered into a strategic partnership with a leading packaging company to develop advanced slip additives that improve the performance of flexible packaging materials. This collaboration underscores Honeywell's focus on innovation and its intent to integrate cutting-edge technology into its product offerings. The partnership is expected to yield significant advancements in product performance, further solidifying Honeywell's role as a key player in the market.

As of December the Slip Additives Market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming evident. Companies that prioritize these aspects are likely to differentiate themselves in a crowded market, paving the way for future growth and sustainability.