US Anti-Slip Coatings Market Summary

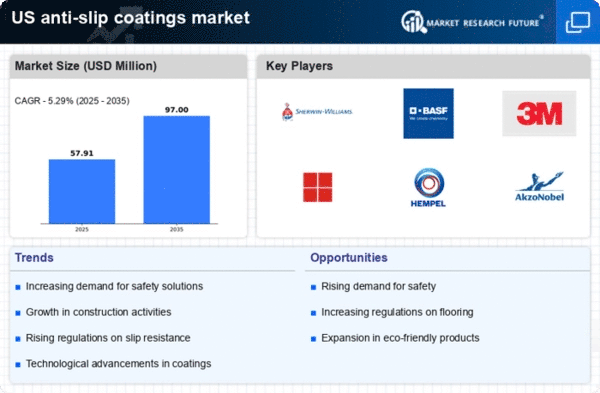

As per Market Research Future analysis, the US anti-slip coatings market size was estimated at 55.0 USD Million in 2024. The US anti slip-coatings market is projected to grow from 57.91 USD Million in 2025 to 97.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US anti slip-coatings market is experiencing a robust growth trajectory driven by safety regulations and technological advancements.

- Rising safety regulations are compelling industries to adopt anti slip-coatings to enhance workplace safety.

- Technological innovations are leading to the development of advanced anti slip-coatings with improved performance characteristics.

- The construction segment remains the largest, while the industrial segment is the fastest-growing in the anti slip-coatings market.

- Increasing demand for safety solutions and expansion of construction activities are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 55.0 (USD Million) |

| 2035 Market Size | 97.0 (USD Million) |

| CAGR (2025 - 2035) | 5.29% |

Major Players

Sherwin-Williams (US), BASF (DE), 3M (US), Rust-Oleum (US), Hempel (DK), AkzoNobel (NL), PPG Industries (US), Nippon Paint (JP), Sika (CH)