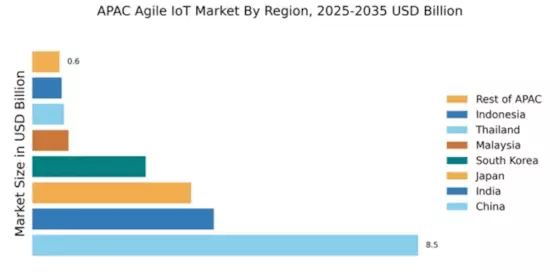

China : China's Dominance in IoT Market

China holds a commanding 8.5% market share in the APAC agile IoT sector, driven by rapid urbanization and a robust manufacturing base. The government's push for smart city initiatives and Industry 4.0 has catalyzed demand for IoT solutions. Regulatory support, such as the Cybersecurity Law, fosters a secure environment for IoT deployment. Infrastructure investments in 5G and cloud computing further enhance connectivity and industrial capabilities.

India : India's Growing IoT Landscape

India's agile IoT market accounts for 4.0% of the APAC share, fueled by a burgeoning tech-savvy population and increasing smartphone penetration. Government initiatives like Digital India and Make in India are pivotal in driving IoT adoption across sectors such as agriculture and healthcare. The demand for smart solutions is rising, particularly in urban areas, supported by favorable policies and investments in digital infrastructure.

Japan : Japan's Technological Advancements

Japan captures 3.5% of the APAC agile IoT market, characterized by its advanced technology landscape and strong R&D capabilities. The government promotes IoT through initiatives like the IoT Acceleration Consortium, encouraging collaboration among industries. Demand is particularly high in manufacturing and automotive sectors, where IoT enhances efficiency and productivity, supported by robust infrastructure and a skilled workforce.

South Korea : South Korea's IoT Ecosystem

South Korea holds a 2.5% market share in the agile IoT sector, driven by smart city projects and a strong telecommunications infrastructure. The government’s focus on digital transformation and innovation fosters a conducive environment for IoT adoption. Cities like Seoul and Busan are at the forefront, implementing IoT solutions in urban management, transportation, and public safety, attracting major players like Samsung and LG.

Malaysia : Malaysia's Evolving Market Dynamics

Malaysia's agile IoT market represents 0.8% of the APAC share, with growth driven by government initiatives like the National IoT Strategic Roadmap. The increasing demand for smart solutions in sectors such as agriculture and manufacturing is notable. Investments in digital infrastructure and a focus on enhancing connectivity are pivotal for market expansion, supported by local startups and international players.

Thailand : Thailand's IoT Market Potential

Thailand accounts for 0.7% of the APAC agile IoT market, with growth fueled by the government's Thailand 4.0 initiative, promoting digital transformation. The demand for IoT solutions is rising in sectors like logistics and healthcare, driven by urbanization and a growing middle class. Key cities such as Bangkok are emerging as innovation hubs, attracting investments from both local and international companies.

Indonesia : Indonesia's Market Growth Trajectory

Indonesia's agile IoT market holds a 0.65% share in APAC, with significant growth potential driven by a young population and increasing internet penetration. Government initiatives aimed at enhancing digital infrastructure are crucial for IoT adoption. Key sectors include agriculture and retail, where IoT solutions are being integrated to improve efficiency and customer engagement, supported by local startups and global players.

Rest of APAC : Opportunities in Emerging Markets

The Rest of APAC accounts for 0.6% of the agile IoT market, characterized by diverse economic conditions and varying levels of technology adoption. Countries in this category are increasingly recognizing the importance of IoT for economic development. Local governments are implementing policies to encourage digital transformation, with sectors like energy and transportation showing promising growth potential.