China : Robust Growth Driven by Demand

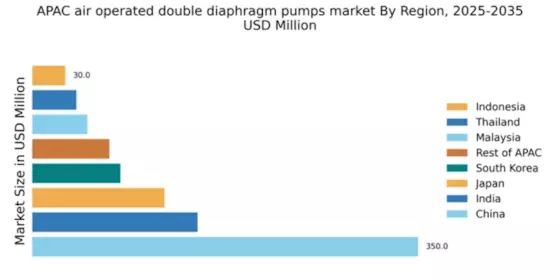

China holds a commanding market share of 50% in the air-operated double-diaphragm pumps sector, valued at $350.0 million. Key growth drivers include rapid industrialization, increasing demand from the chemical and food processing industries, and government initiatives promoting infrastructure development. Regulatory policies favoring environmental sustainability are also shaping consumption patterns, leading to a surge in demand for efficient pumping solutions. The country's extensive industrial base supports a robust infrastructure for manufacturing and distribution.

India : Rapid Industrial Growth and Demand

India's market for air-operated double-diaphragm pumps is valued at $150.0 million, accounting for 20% of the APAC market. The growth is fueled by expanding manufacturing sectors, particularly in pharmaceuticals and chemicals, alongside government initiatives like 'Make in India' that encourage local production. Demand trends indicate a shift towards automation and efficiency, with increasing consumption in urban areas. Regulatory frameworks are evolving to support sustainable practices in manufacturing.

Japan : High Standards in Pump Manufacturing

Japan's air-operated double-diaphragm pump market is valued at $120.0 million, representing 16% of the APAC market. The growth is driven by technological advancements and a strong emphasis on quality and reliability in manufacturing. Demand is particularly high in sectors such as automotive and electronics, where precision is critical. Government regulations promote innovation and environmental sustainability, further enhancing market dynamics.

South Korea : Key Player in Advanced Manufacturing

South Korea's market for air-operated double-diaphragm pumps is valued at $80.0 million, capturing 10% of the APAC market. The growth is supported by a robust industrial base, particularly in electronics and chemicals. Demand trends show a preference for high-efficiency pumps, driven by competitive manufacturing practices. Regulatory policies are increasingly focused on environmental standards, promoting the adoption of advanced pumping technologies.

Malaysia : Strategic Location for Manufacturing

Malaysia's air-operated double-diaphragm pump market is valued at $50.0 million, accounting for 7% of the APAC market. The growth is driven by the country's strategic location and its role as a manufacturing hub for various industries, including palm oil and chemicals. Demand is increasing in urban areas, supported by government initiatives to enhance industrial capabilities. Regulatory frameworks are evolving to ensure compliance with international standards.

Thailand : Focus on Sustainable Manufacturing

Thailand's market for air-operated double-diaphragm pumps is valued at $40.0 million, representing 5% of the APAC market. The growth is driven by expanding manufacturing sectors, particularly in food processing and automotive. Demand trends indicate a shift towards sustainable practices, supported by government policies promoting eco-friendly technologies. The competitive landscape includes both local and international players, enhancing market dynamics.

Indonesia : Potential for Industrial Expansion

Indonesia's air-operated double-diaphragm pump market is valued at $30.0 million, capturing 4% of the APAC market. The growth is fueled by increasing industrial activities, particularly in mining and agriculture. Demand trends show a rising need for efficient pumping solutions, supported by government initiatives to boost infrastructure development. Regulatory policies are gradually evolving to enhance industrial standards and sustainability practices.

Rest of APAC : Varied Applications Across Industries

The Rest of APAC market for air-operated double-diaphragm pumps is valued at $70.0 million, accounting for 9% of the overall market. This sub-region encompasses a variety of markets with unique demands, driven by local industries such as textiles, food processing, and pharmaceuticals. Demand trends indicate a growing preference for customized solutions tailored to specific applications. Regulatory frameworks are diverse, reflecting the varied industrial landscapes across these countries.