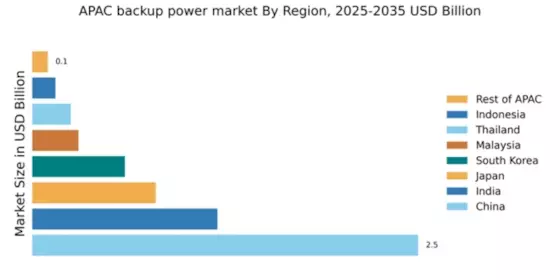

China : Robust Growth Driven by Demand

Key markets include major cities like Beijing, Shanghai, and Shenzhen, where industrial and commercial activities are concentrated. The competitive landscape features significant players such as Generac Holdings and Cummins, alongside local manufacturers. The business environment is characterized by a mix of established brands and emerging companies, catering to diverse applications from residential to large-scale industrial use. The demand for backup power solutions is particularly strong in the telecommunications and healthcare sectors.

India : Rapid Urbanization Fuels Demand

Cities like Mumbai, Delhi, and Bangalore are pivotal markets, showcasing high demand for backup power systems. The competitive landscape includes major players like Kohler Co and Eaton Corporation, alongside numerous local manufacturers. The business environment is dynamic, with a mix of established and emerging companies catering to residential, commercial, and industrial sectors. The IT and telecommunications industries are significant consumers of backup power solutions, driving innovation and competition.

Japan : Focus on Reliability and Innovation

Key markets include Tokyo and Osaka, where the concentration of businesses and infrastructure heightens the demand for backup power. The competitive landscape features major players like Honda Motor Co and Schneider Electric, known for their innovative solutions. The business environment is robust, with a focus on high-quality products and services. The residential sector, along with critical infrastructure like hospitals and data centers, drives the demand for reliable backup power systems.

South Korea : Industrial Growth Drives Power Needs

Seoul and Busan are key markets, showcasing significant demand for backup power systems. The competitive landscape includes major players like Siemens AG and Cummins, alongside local firms. The business environment is characterized by innovation and a focus on high-efficiency products. The technology sector, particularly semiconductor manufacturing, is a major consumer of backup power solutions, driving market growth and competition.

Malaysia : Infrastructure Development Boosts Market

Kuala Lumpur and Penang are key markets, where industrial and commercial activities are concentrated. The competitive landscape features players like Atlas Copco and Generac, alongside local manufacturers. The business environment is evolving, with a mix of established brands and new entrants. The telecommunications and manufacturing sectors are significant consumers of backup power solutions, driving innovation and competition.

Thailand : Industrial Demand Fuels Power Solutions

Bangkok and Chonburi are key markets, showcasing significant demand for backup power systems. The competitive landscape includes major players like Kohler Co and Cummins, alongside local firms. The business environment is characterized by a mix of established brands and emerging companies. The manufacturing sector, particularly automotive and electronics, is a major consumer of backup power solutions, driving market growth.

Indonesia : Growing Demand for Reliable Power

Jakarta and Surabaya are key markets, where industrial and commercial activities are concentrated. The competitive landscape features players like Generac Holdings and local manufacturers. The business environment is evolving, with a mix of established brands and new entrants. The telecommunications and manufacturing sectors are significant consumers of backup power solutions, driving innovation and competition.

Rest of APAC : Emerging Trends Across Sub-regions

Countries like Vietnam, Philippines, and Bangladesh are key markets, showcasing significant demand for backup power systems. The competitive landscape includes a mix of local and international players, each catering to specific market needs. The business environment is characterized by emerging opportunities and challenges, with sectors like telecommunications and healthcare driving demand for backup power solutions.