Expansion of Renewable Energy Sources

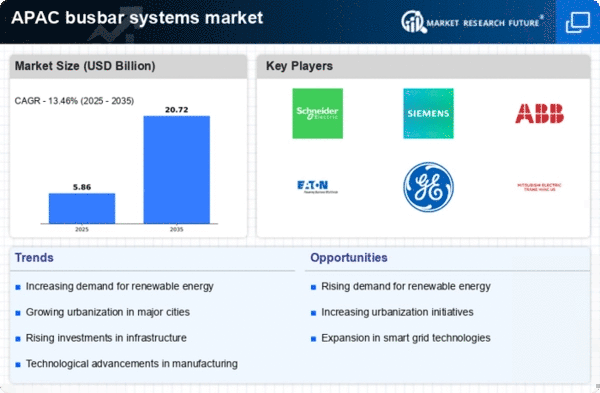

The transition towards renewable energy sources is significantly influencing the busbar systems market in APAC. Governments and private sectors are investing heavily in solar, wind, and hydroelectric power, necessitating robust electrical infrastructure to support these initiatives. Busbar systems play a crucial role in connecting renewable energy sources to the grid, ensuring efficient power distribution. Recent statistics indicate that renewable energy capacity in APAC is expected to reach over 1,500 GW by 2030, representing a substantial increase from previous years. This growth in renewable energy generation creates a corresponding demand for advanced busbar systems that can handle variable loads and enhance grid stability. As the region continues to prioritize clean energy, the busbar systems market is poised for significant expansion, driven by the need for reliable and efficient power distribution solutions.

Infrastructure Development Initiatives

Ongoing infrastructure development initiatives across APAC are acting as a catalyst for the busbar systems market. Governments are investing in upgrading and expanding electrical grids to accommodate growing urban populations and industrial activities. This investment is reflected in various projects, including smart city developments and industrial parks, which require efficient power distribution systems. The APAC region is expected to allocate over $1 trillion towards infrastructure development by 2030, with a significant portion directed towards electrical infrastructure. As a result, the demand for busbar systems is likely to increase, as they provide a compact and efficient solution for power distribution in these large-scale projects. The emphasis on modernizing infrastructure is expected to create a favorable environment for the busbar systems market, driving innovation and adoption in the coming years.

Increasing Demand for Energy Efficiency

The busbar systems market in APAC is experiencing a notable surge in demand for energy-efficient solutions. As industries and commercial establishments strive to reduce operational costs and enhance sustainability, the adoption of busbar systems is becoming increasingly prevalent. These systems facilitate efficient power distribution, minimizing energy losses during transmission. According to recent data, the energy efficiency market in APAC is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This trend indicates a strong inclination towards technologies that optimize energy use, thereby driving the busbar systems market. Furthermore, the integration of smart technologies within busbar systems enhances their efficiency, making them a preferred choice for modern electrical infrastructure. Consequently, the increasing focus on energy efficiency is likely to propel the growth of the busbar systems market in the region.

Rising Industrialization and Urban Growth

The rapid pace of industrialization and urban growth in APAC is significantly impacting the busbar systems market. As cities expand and industries proliferate, the demand for reliable and efficient power distribution systems intensifies. The region is witnessing a substantial increase in manufacturing and service sectors, which require robust electrical infrastructure to support their operations. Recent reports suggest that industrial output in APAC is projected to grow by approximately 6% annually through 2030. This growth necessitates the implementation of advanced busbar systems that can efficiently manage increased power loads and enhance operational reliability. Consequently, the rising industrialization and urbanization trends are likely to drive the busbar systems market, as stakeholders seek solutions that can accommodate the growing energy demands of urban centers and industrial facilities.

Technological Innovations in Power Distribution

Technological innovations are reshaping the landscape of the busbar systems market in APAC. The integration of smart technologies, such as IoT and automation, is enhancing the functionality and efficiency of busbar systems. These innovations enable real-time monitoring and management of power distribution, leading to improved reliability and reduced downtime. The market for smart electrical systems is anticipated to grow at a CAGR of around 10% from 2025 to 2030, indicating a strong trend towards adopting advanced technologies in power distribution. As industries and utilities seek to modernize their electrical infrastructure, the demand for innovative busbar systems is likely to increase. This trend suggests that technological advancements will play a pivotal role in driving the growth of the busbar systems market, as stakeholders prioritize efficiency and reliability in their power distribution solutions.