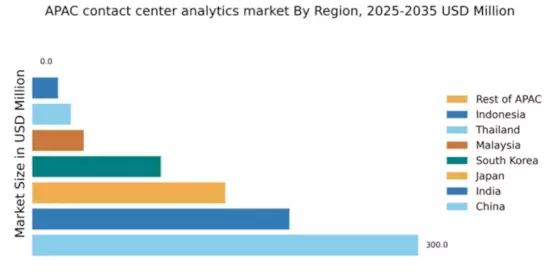

China : Unmatched Growth and Innovation

China holds a commanding market share of 50% in the APAC contact center-analytics market, valued at $300.0 million. Key growth drivers include rapid digital transformation, increasing demand for AI-driven analytics, and government initiatives promoting smart city projects. The regulatory environment is supportive, with policies encouraging technological advancements and infrastructure development, particularly in urban areas. The rise of e-commerce and online services has further fueled demand for sophisticated analytics solutions.

India : Transforming Customer Engagement Strategies

India captures a significant 33.3% market share, valued at $200.0 million. The growth is driven by the increasing adoption of cloud-based solutions and a burgeoning startup ecosystem. Demand trends indicate a shift towards omnichannel customer engagement, supported by government initiatives like Digital India. The infrastructure is improving, with investments in broadband and data centers enhancing service delivery capabilities.

Japan : Focus on Quality and Efficiency

Japan holds a 25% market share, valued at $150.0 million. The market is driven by a strong emphasis on quality customer service and advanced technology integration. Demand for analytics is rising as businesses seek to enhance operational efficiency. Regulatory policies support innovation, particularly in AI and machine learning applications, while infrastructure investments in telecommunications bolster service capabilities.

South Korea : Leading in AI and Automation

South Korea accounts for 16.7% of the market, valued at $100.0 million. The growth is fueled by high internet penetration and a tech-savvy population. Demand for AI-driven analytics is on the rise, supported by government initiatives promoting smart technologies. Key cities like Seoul and Busan are central to market activities, with major players like Cisco and Genesys establishing a strong presence.

Malaysia : Investments in Digital Transformation

Malaysia holds a 6.7% market share, valued at $40.0 million. The market is driven by increasing investments in digital transformation and a growing focus on customer experience. Government initiatives like the Malaysia Digital Economy Corporation (MDEC) are fostering a conducive environment for analytics adoption. The competitive landscape includes local and international players, with Kuala Lumpur being a key market.

Thailand : Focus on Service Excellence

Thailand captures a 5% market share, valued at $30.0 million. The growth is driven by a rising demand for customer analytics in sectors like tourism and retail. Government policies promoting digital economy initiatives are enhancing the business environment. Bangkok is a key market, with local firms increasingly adopting analytics solutions to improve customer engagement and service quality.

Indonesia : Focus on Infrastructure Development

Indonesia holds a 3.3% market share, valued at $20.0 million. The market is characterized by a growing demand for contact center analytics, driven by the expansion of e-commerce and digital services. Government initiatives aimed at improving digital infrastructure are crucial for market growth. Key cities like Jakarta are emerging as hubs for analytics adoption, with local and international players vying for market share.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for a negligible market share, valued at $0.0 million. This sub-region presents a fragmented landscape with diverse market needs and varying levels of analytics adoption. Growth is influenced by local economic conditions and regulatory environments. Countries in this category are gradually recognizing the importance of analytics in enhancing customer engagement and operational efficiency.