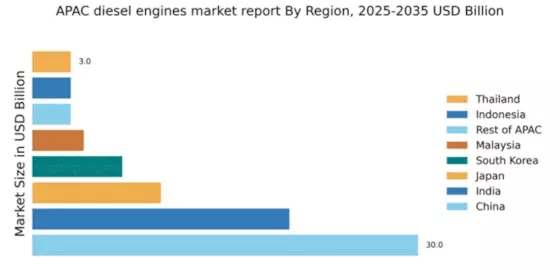

China : Robust Growth Driven by Demand

Key markets include major cities like Shanghai, Beijing, and Shenzhen, where industrial activities are concentrated. The competitive landscape features strong players such as Caterpillar Inc, Cummins Inc, and Mitsubishi Heavy Industries, all vying for market share. Local dynamics are influenced by a growing emphasis on sustainability and efficiency in diesel engine applications, particularly in logistics and heavy machinery sectors. The business environment is favorable, with government support for technological advancements and infrastructure development.

India : Strong Demand from Diverse Sectors

Key markets include states like Maharashtra, Gujarat, and Tamil Nadu, where industrial activities are thriving. The competitive landscape features major players such as Cummins Inc and Tata Motors, alongside local manufacturers. The business environment is dynamic, with a mix of established and emerging companies. Diesel engines are widely used in agriculture for tractors and generators, while the construction sector relies heavily on robust diesel machinery for projects.

Japan : Focus on Efficiency and Sustainability

Key markets include Tokyo and Osaka, where industrial and technological hubs are located. Major players like Mitsubishi Heavy Industries and Yanmar Co Ltd dominate the landscape, focusing on high-quality, efficient products. The competitive environment is characterized by a strong emphasis on R&D, with companies investing heavily in new technologies. Diesel engines are widely used in transportation and marine applications, reflecting Japan's advanced industrial capabilities.

South Korea : Industrial Demand Fuels Market Expansion

Key markets include Busan and Incheon, which are vital for shipping and logistics. Major players like Hyundai Heavy Industries and Doosan Infracore are significant contributors to the market. The competitive landscape is marked by a blend of local and international companies, fostering innovation and efficiency. Diesel engines are primarily used in heavy machinery and commercial vehicles, reflecting the industrial focus of the region.

Malaysia : Infrastructure Development Drives Growth

Key markets include Kuala Lumpur and Johor, where industrial activities are concentrated. The competitive landscape features players like Perkins Engines Company Limited and local manufacturers. The business environment is supportive, with government backing for technological advancements. Diesel engines are widely used in agriculture for machinery and in transportation for commercial vehicles, reflecting the diverse applications in the region.

Thailand : Industrial Applications Drive Demand

Key markets include Bangkok and Chonburi, where industrial activities are concentrated. Major players like Scania AB and local manufacturers are significant in the competitive landscape. The business environment is favorable, with government support for innovation and infrastructure projects. Diesel engines are widely used in transportation and agriculture, reflecting the diverse industrial applications in Thailand.

Indonesia : Infrastructure Growth Fuels Demand

Key markets include Jakarta and Surabaya, where industrial activities are concentrated. The competitive landscape features players like Caterpillar Inc and local manufacturers. The business environment is dynamic, with a mix of established and emerging companies. Diesel engines are widely used in agriculture for machinery and in mining for heavy equipment, reflecting the diverse applications in the region.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include various countries in Southeast Asia and the Pacific Islands, where industrial activities are growing. The competitive landscape features a blend of local and international companies, fostering innovation and efficiency. Diesel engines are used in various sectors, including agriculture, transportation, and construction, reflecting the diverse applications across the region.