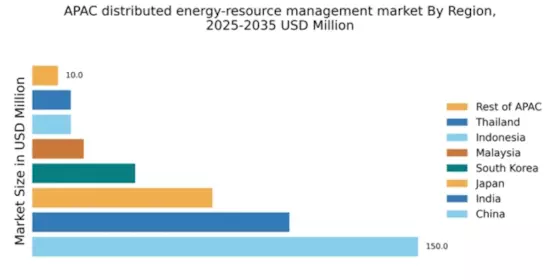

China : China's Leadership in Energy Management

China holds a commanding market share of 150.0, representing a significant portion of the APAC distributed energy-resource-management market. Key growth drivers include robust government policies promoting renewable energy, substantial investments in smart grid technology, and increasing urbanization. Demand trends indicate a shift towards decentralized energy solutions, supported by initiatives like the 14th Five-Year Plan, which emphasizes clean energy and sustainability. Infrastructure development, particularly in cities like Beijing and Shanghai, further bolsters this growth.

India : India's Emerging Energy Landscape

India's market share stands at 100.0, fueled by a growing demand for energy security and sustainability. The government's push for renewable energy, particularly solar and wind, is a key growth driver. Initiatives like the National Solar Mission and various state-level policies are enhancing the consumption of distributed energy resources. Urban centers such as Delhi and Mumbai are witnessing increased investments in energy management technologies, reflecting a shift towards cleaner energy solutions.

Japan : Japan's Technological Advancements in Energy

Japan's market share is valued at 70.0, characterized by a strong focus on innovation and technology in energy management. The government's commitment to reducing greenhouse gas emissions and promoting energy efficiency drives market growth. Demand for distributed energy resources is rising, particularly in urban areas like Tokyo and Osaka, where energy resilience is critical. Regulatory frameworks support the integration of renewable energy into the grid, fostering a competitive landscape for major players.

South Korea : South Korea's Energy Transition Journey

With a market share of 40.0, South Korea is rapidly advancing in distributed energy-resource management. The government's Green New Deal aims to enhance renewable energy adoption and reduce reliance on fossil fuels. Demand trends show a growing interest in smart energy solutions, particularly in cities like Seoul and Busan. The competitive landscape features significant players like Siemens and ABB, investing in local partnerships to drive innovation and efficiency in energy management.

Malaysia : Malaysia's Energy Market Evolution

Malaysia's market share is at 20.0, driven by increasing awareness of renewable energy benefits and government incentives. The Sustainable Energy Development Authority (SEDA) promotes initiatives that encourage the adoption of distributed energy resources. Key cities like Kuala Lumpur are witnessing a surge in demand for energy-efficient solutions, supported by local policies aimed at reducing carbon emissions. The market is competitive, with players like Schneider Electric establishing a strong presence.

Thailand : Thailand's Renewable Energy Initiatives

Thailand holds a market share of 15.0, characterized by a growing interest in renewable energy and energy efficiency. The government's Power Development Plan emphasizes the integration of distributed energy resources. Demand is particularly strong in urban areas such as Bangkok, where energy consumption is high. The competitive landscape includes local and international players, with significant investments in solar and wind energy projects enhancing market dynamics.

Indonesia : Indonesia's Energy Resource Development

Indonesia's market share is also 15.0, with significant potential for growth in distributed energy-resource management. The government's commitment to increasing renewable energy capacity is a key driver, supported by initiatives like the 2025 Renewable Energy Target. Key markets include Jakarta and Surabaya, where energy demand is rising. The competitive landscape features both local and international players, with a focus on solar and biomass energy solutions.

Rest of APAC : Emerging Markets in APAC

The Rest of APAC holds a market share of 10.0, showcasing diverse opportunities in distributed energy-resource management. Countries like Vietnam and the Philippines are increasingly adopting renewable energy solutions, driven by government policies and international investments. Demand trends indicate a shift towards localized energy solutions, particularly in urban areas. The competitive landscape is evolving, with various players entering the market to capitalize on growth potential.