China : Unmatched Growth and Innovation

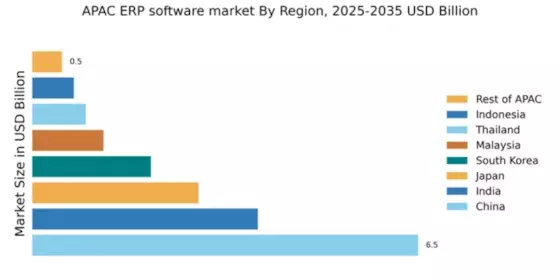

China holds a commanding 6.5% market share in the APAC ERP software sector, driven by rapid digital transformation and government initiatives promoting smart manufacturing. The demand for ERP solutions is fueled by the increasing need for operational efficiency and data-driven decision-making across industries. Regulatory support, such as the Made in China 2025 initiative, enhances infrastructure development, fostering a conducive environment for ERP adoption.

India : Emerging Market with High Potential

India's ERP software market is valued at 3.8%, reflecting a surge in demand driven by the growing SME sector and digitalization efforts. Government initiatives like Digital India are catalyzing ERP adoption, particularly in manufacturing and retail. The increasing focus on automation and cloud-based solutions is reshaping consumption patterns, with businesses seeking integrated systems for better resource management.

Japan : Balancing Tradition and Innovation

Japan's ERP market, accounting for 2.8%, is characterized by a blend of traditional practices and modern technology. Key growth drivers include the aging workforce and the need for automation in sectors like manufacturing and logistics. Regulatory frameworks support innovation, while government initiatives encourage digital transformation, making ERP solutions essential for maintaining competitiveness in a global market.

South Korea : Innovation at the Forefront

South Korea's ERP market, with a share of 2.0%, is propelled by its advanced technology landscape and high internet penetration. The demand for ERP systems is driven by the need for real-time data analytics and operational efficiency. Government policies promoting smart factories and Industry 4.0 initiatives are key growth factors, enhancing the business environment for ERP providers.

Malaysia : Strategic Hub for Businesses

Malaysia's ERP market, valued at 1.2%, is witnessing growth due to the increasing number of SMEs and government support for digital transformation. Initiatives like the Malaysia Digital Economy Corporation (MDEC) are fostering an environment conducive to ERP adoption. The demand is particularly strong in sectors such as manufacturing and services, where integrated solutions are becoming essential for operational efficiency.

Thailand : Focus on Digital Transformation

Thailand's ERP market, accounting for 0.9%, is on the rise as businesses increasingly recognize the need for integrated solutions. Government initiatives aimed at enhancing the digital economy are driving demand, particularly in manufacturing and retail sectors. The competitive landscape features both local and international players, with a growing emphasis on cloud-based ERP solutions to meet evolving business needs.

Indonesia : Growth Opportunities Await

Indonesia's ERP market, with a share of 0.7%, is still developing but shows significant potential for growth. The increasing focus on digitalization and government support for SMEs are key drivers. Demand is rising in sectors like retail and manufacturing, where businesses seek to streamline operations. The competitive landscape is evolving, with both local and international players vying for market share.

Rest of APAC : Varied Needs Across Regions

The Rest of APAC, holding a 0.5% market share, presents a diverse landscape for ERP solutions. Different countries exhibit unique demands based on their economic conditions and industrial focus. Government initiatives aimed at enhancing digital infrastructure are driving ERP adoption in various sectors. The competitive environment is characterized by a mix of local and global players, each catering to specific regional needs.