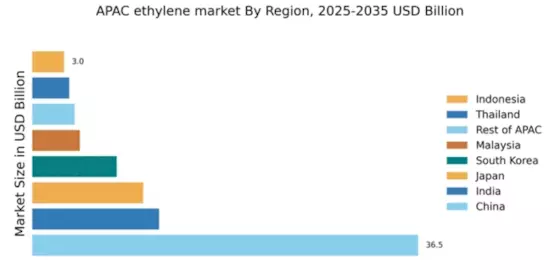

China : Unmatched Growth and Demand Trends

China holds a commanding 36.5% market share in the APAC ethylene market, valued at approximately $XX billion. Key growth drivers include rapid industrialization, urbanization, and increasing demand for plastics in packaging and automotive sectors. Government initiatives, such as the Made in China 2025 plan, aim to enhance domestic production capabilities. Additionally, significant investments in infrastructure and petrochemical facilities bolster the market's growth trajectory.

India : Rapid Growth in Petrochemical Sector

India accounts for 12.0% of the APAC ethylene market, valued at around $XX billion. The growth is fueled by increasing demand for consumer goods, automotive, and construction materials. Government policies promoting 'Make in India' and investments in refining capacity are pivotal. The expanding middle class and urbanization trends further drive consumption patterns, while regulatory frameworks are evolving to support sustainable practices.

Japan : Innovation and Sustainability Focus

Japan holds a 10.5% share in the APAC ethylene market, valued at approximately $XX billion. The market is driven by advanced technology and a strong emphasis on sustainability. Demand for high-performance plastics in electronics and automotive industries is rising. Government regulations encourage eco-friendly practices, while investments in R&D enhance production efficiency and product quality, ensuring competitiveness in the global market.

South Korea : Strategic Location and Innovation

South Korea represents 8.0% of the APAC ethylene market, valued at around $XX billion. The market is driven by strong demand in the automotive and electronics sectors. Major players like LG Chem and SK Global Chemical dominate the landscape, supported by government initiatives to boost petrochemical production. The country's strategic location facilitates exports, while local consumption patterns reflect a shift towards high-value applications.

Malaysia : Strategic Investments and Development

Malaysia captures 4.5% of the APAC ethylene market, valued at approximately $XX billion. The growth is driven by investments in petrochemical facilities and a favorable business environment. Government policies support the development of the chemical industry, while demand for ethylene derivatives in packaging and construction is on the rise. The country's infrastructure development enhances its competitive edge in the region.

Thailand : Focus on Sustainable Development

Thailand holds a 3.5% share in the APAC ethylene market, valued at around $XX billion. The market is driven by increasing demand in automotive, packaging, and consumer goods sectors. Government initiatives promote sustainable practices and investment in petrochemical infrastructure. The competitive landscape features local players like PTT Global Chemical, which are expanding their production capabilities to meet growing domestic and export demands.

Indonesia : Rising Demand and Infrastructure Needs

Indonesia accounts for 3.0% of the APAC ethylene market, valued at approximately $XX billion. The market is driven by rising demand for plastics in various sectors, including construction and consumer goods. Government initiatives to enhance industrial infrastructure and attract foreign investment are crucial. Local players are expanding capacities, while regulatory frameworks are evolving to support sustainable growth in the petrochemical sector.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC captures 4.0% of the ethylene market, valued at around $XX billion. This sub-region includes various countries with distinct market dynamics. Growth drivers vary, with some focusing on local consumption while others emphasize exports. Regulatory policies and government initiatives differ significantly, impacting market conditions. The competitive landscape features both local and international players, adapting to regional demands and trends.