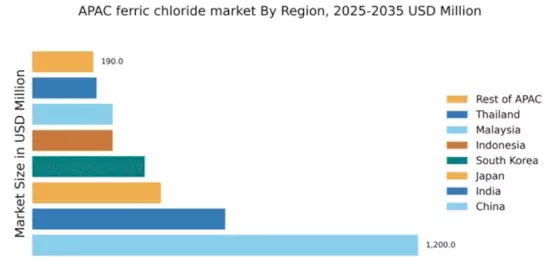

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 50% in the APAC ferric chloride market, valued at $1200.0 million. Key growth drivers include rapid industrialization, urbanization, and increasing water treatment needs. The government has implemented stringent environmental regulations, promoting the use of ferric chloride in wastewater treatment. Infrastructure development, particularly in cities like Shanghai and Beijing, further fuels demand as industries seek efficient solutions for water purification.

India : Strong Demand from Water Treatment

India accounts for 25% of the APAC ferric chloride market, valued at $600.0 million. The growth is driven by increasing urbanization and government initiatives aimed at improving water quality. Demand trends indicate a rising consumption in industrial applications, particularly in textile and paper industries. Regulatory policies are becoming more stringent, pushing industries to adopt eco-friendly solutions, including ferric chloride for effluent treatment.

Japan : Innovation in Water Treatment Solutions

Japan holds a 16.67% market share in the APAC ferric chloride market, valued at $400.0 million. The growth is supported by advanced technology in water treatment and a strong focus on environmental sustainability. Demand is stable, with consumption patterns reflecting a shift towards high-purity ferric chloride for industrial applications. Government initiatives promote the use of innovative technologies in wastewater management, enhancing market prospects.

South Korea : Focus on Industrial Applications

South Korea represents 14.58% of the APAC ferric chloride market, valued at $350.0 million. The market is driven by increasing industrial activities and stringent environmental regulations. Demand trends show a growing preference for ferric chloride in semiconductor manufacturing and water treatment. The government supports initiatives for sustainable industrial practices, enhancing the market's growth potential in cities like Seoul and Busan.

Malaysia : Strategic Location for Industrial Growth

Malaysia captures 10.42% of the APAC ferric chloride market, valued at $250.0 million. The growth is fueled by increasing investments in water treatment infrastructure and industrial development. Demand trends indicate a rise in consumption for municipal water treatment and industrial applications. Government policies are focused on enhancing water quality, driving the adoption of ferric chloride in various sectors, particularly in Kuala Lumpur and Penang.

Thailand : Key Market for Ferric Chloride

Thailand holds a 8.33% market share in the APAC ferric chloride market, valued at $200.0 million. The growth is driven by increasing urbanization and government initiatives aimed at improving water quality. Demand trends show a rising consumption in industrial applications, particularly in food processing and textiles. Regulatory policies are becoming more stringent, pushing industries to adopt eco-friendly solutions, including ferric chloride for effluent treatment.

Indonesia : Focus on Infrastructure Development

Indonesia accounts for 10.42% of the APAC ferric chloride market, valued at $250.0 million. The market is driven by rapid urbanization and increasing investments in water treatment facilities. Demand trends indicate a growing consumption in industrial applications, particularly in mining and agriculture. Government initiatives are focused on enhancing water quality and promoting sustainable practices, creating a favorable environment for ferric chloride adoption.

Rest of APAC : Varied Applications Across Industries

The Rest of APAC captures a 7.92% market share in the ferric chloride market, valued at $190.0 million. The growth is driven by diverse industrial applications and varying regulatory environments. Demand trends show a mix of consumption patterns, with significant use in water treatment and chemical manufacturing. Local market dynamics vary widely, influenced by regional policies and industrial needs, creating opportunities for key players in this segment.