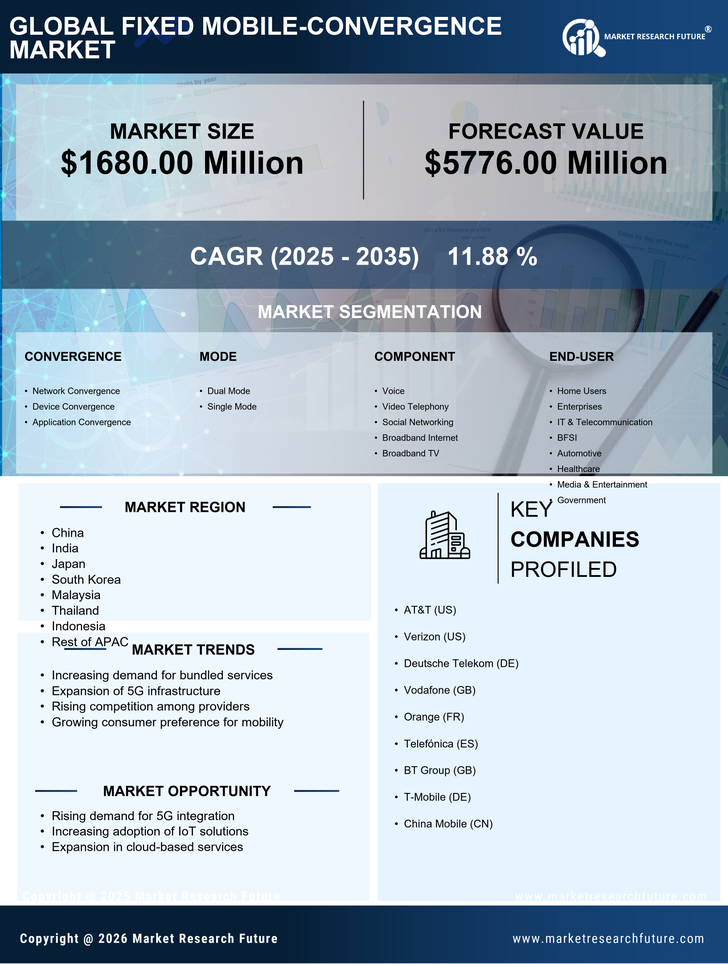

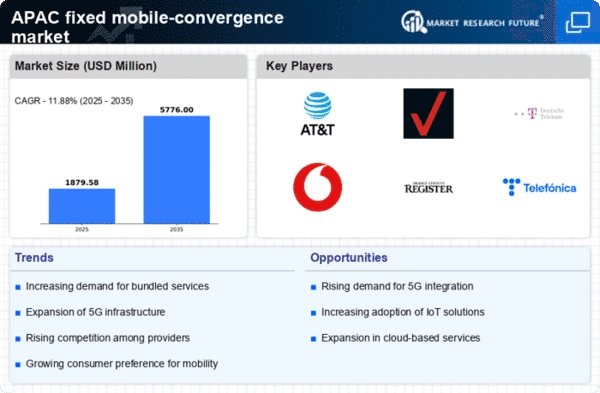

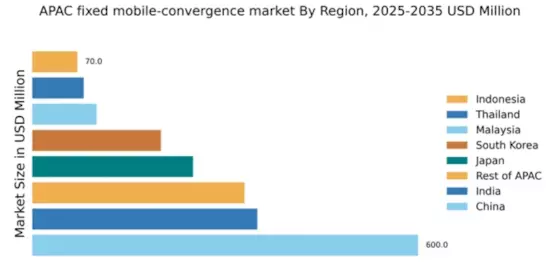

China : Unmatched Growth and Infrastructure

China holds a commanding market share of 36% with a value of $600.0 million in the fixed mobile-convergence sector. Key growth drivers include rapid urbanization, increasing smartphone penetration, and government initiatives promoting digital infrastructure. The demand for seamless connectivity is rising, supported by favorable regulatory policies that encourage competition and innovation. Significant investments in 5G technology and smart city projects further enhance the industrial landscape.

India : Emerging Market with High Demand

India accounts for 21% of the APAC market, valued at $350.0 million. The growth is driven by a young population, increasing internet usage, and government initiatives like Digital India. Demand for affordable mobile services is surging, with a focus on rural connectivity. Regulatory support, including spectrum allocation for 5G, is fostering a competitive environment, while infrastructure development is crucial for meeting rising consumer expectations.

Japan : Innovation and Quality Service Focus

Japan holds a 15% market share, valued at $250.0 million, characterized by high consumer expectations for quality and innovation. Key growth drivers include the adoption of IoT and smart home technologies, alongside government support for digital transformation. The market is witnessing a shift towards bundled services, with consumers seeking integrated solutions. Regulatory frameworks are conducive to fostering competition and enhancing service quality.

South Korea : Pioneering Digital Transformation

South Korea represents 12% of the market, valued at $200.0 million, driven by its leadership in 5G technology and high-speed internet services. The government’s proactive policies support digital innovation, while consumer demand for high-quality mobile services continues to rise. Major cities like Seoul and Busan are key markets, with a competitive landscape featuring local giants like SK Telecom and KT Corporation, focusing on smart city applications and IoT solutions.

Malaysia : Emerging Hub for Connectivity Solutions

Malaysia captures 6% of the APAC market, valued at $100.0 million, with growth fueled by increasing smartphone adoption and government initiatives like the National Fiberisation and Connectivity Plan. Demand for bundled services is rising, particularly in urban areas like Kuala Lumpur. The competitive landscape includes major players like Telekom Malaysia and Maxis, focusing on enhancing service delivery and expanding coverage in underserved regions.

Thailand : Focus on Rural Connectivity Initiatives

Thailand holds a 5% market share, valued at $80.0 million, with growth driven by increasing mobile penetration and government efforts to improve rural connectivity. The demand for affordable mobile services is significant, supported by regulatory initiatives promoting competition. Key markets include Bangkok and Chiang Mai, where major players like AIS and True Corporation are enhancing service offerings to meet consumer needs.

Indonesia : Rising Demand for Connectivity Solutions

Indonesia accounts for 4% of the APAC market, valued at $70.0 million, driven by a young population and increasing smartphone usage. Government initiatives aimed at improving digital infrastructure are crucial for market growth. The competitive landscape features local players like Telkomsel and XL Axiata, focusing on expanding coverage in urban and rural areas. Demand for mobile data services is rapidly increasing, reflecting changing consumer behavior.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a 20% market share, valued at $330.0 million, characterized by diverse market conditions and varying levels of infrastructure development. Growth drivers include increasing mobile penetration and government initiatives to enhance connectivity. The competitive landscape varies significantly, with local players adapting to unique market dynamics. Key sectors include e-commerce and digital services, reflecting the region's evolving consumer preferences.