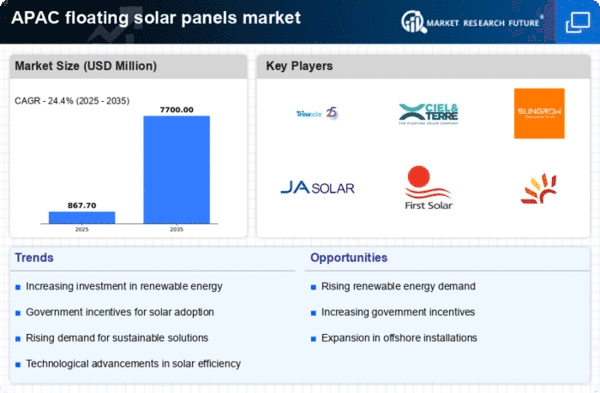

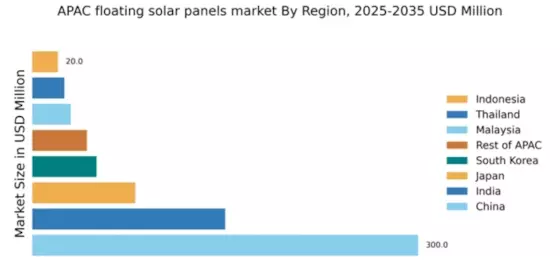

China : Unmatched Growth and Innovation

China holds a commanding market share of 300.0 MW, representing a significant portion of the APAC floating solar panel market. Key growth drivers include government incentives for renewable energy, rapid industrialization, and increasing energy demands. The country has implemented favorable regulatory policies, such as the Renewable Energy Law, which promotes solar energy adoption. Infrastructure development, particularly in coastal and water-scarce regions, further supports the expansion of floating solar technology.

India : Strong Government Support and Demand

India's floating solar market is valued at 150.0 MW, driven by ambitious renewable energy targets and government initiatives like the National Solar Mission. The demand for clean energy is rising, particularly in states like Gujarat and Madhya Pradesh, where water bodies are abundant. Regulatory frameworks encourage private investments, while local manufacturing capabilities are improving. The competitive landscape features major players like Trina Solar and JA Solar, contributing to a vibrant business environment.

Japan : Focus on Sustainability and Technology

Japan's floating solar market is valued at 80.0 MW, characterized by a strong emphasis on sustainability and technological innovation. The government promotes renewable energy through feed-in tariffs and subsidies, driving demand for floating solar installations. Key markets include Tokyo and Osaka, where land scarcity necessitates alternative energy solutions. The competitive landscape includes Ciel & Terre and local firms, fostering a dynamic environment for sector-specific applications in agriculture and aquaculture.

South Korea : Government Initiatives Fuel Expansion

South Korea's floating solar market is valued at 50.0 MW, supported by government initiatives aimed at achieving carbon neutrality by 2050. The country has implemented policies that encourage investment in renewable energy, particularly in regions like Jeju and Gyeonggi-do. The competitive landscape features major players like Sungrow Power Supply, which enhances local capabilities. The business environment is favorable, with increasing interest in integrating floating solar with existing infrastructure.

Malaysia : Potential for Market Expansion

Malaysia's floating solar market is valued at 30.0 MW, with growing interest driven by government policies promoting renewable energy. The country aims to increase its renewable energy share, particularly in states like Selangor and Penang. Demand trends indicate a shift towards sustainable energy solutions, supported by local initiatives. The competitive landscape includes players like Canadian Solar, contributing to a developing market environment focused on energy diversification.

Thailand : Government Policies Drive Adoption

Thailand's floating solar market is valued at 25.0 MW, with significant growth potential fueled by government policies promoting renewable energy. The country is focusing on sustainable energy solutions, particularly in regions like Chonburi and Nakhon Ratchasima. The competitive landscape features both local and international players, enhancing market dynamics. The business environment is evolving, with increasing investments in floating solar technology and applications in agriculture and fisheries.

Indonesia : Focus on Renewable Energy Growth

Indonesia's floating solar market is valued at 20.0 MW, with a growing focus on renewable energy as part of the national energy policy. Key regions include Java and Bali, where water bodies are abundant. The government is encouraging investments in solar energy through various incentives. The competitive landscape is still developing, with opportunities for both local and international players. The business environment is improving, with increasing awareness of sustainable energy solutions.

Rest of APAC : Varied Market Dynamics and Growth

The Rest of APAC floating solar market is valued at 42.51 MW, showcasing diverse opportunities across various countries. Each nation has unique regulatory frameworks and market conditions that influence growth. Demand for floating solar is rising due to increasing energy needs and environmental concerns. The competitive landscape varies, with local players emerging alongside established international firms. The business environment is dynamic, with potential applications in agriculture and water management.