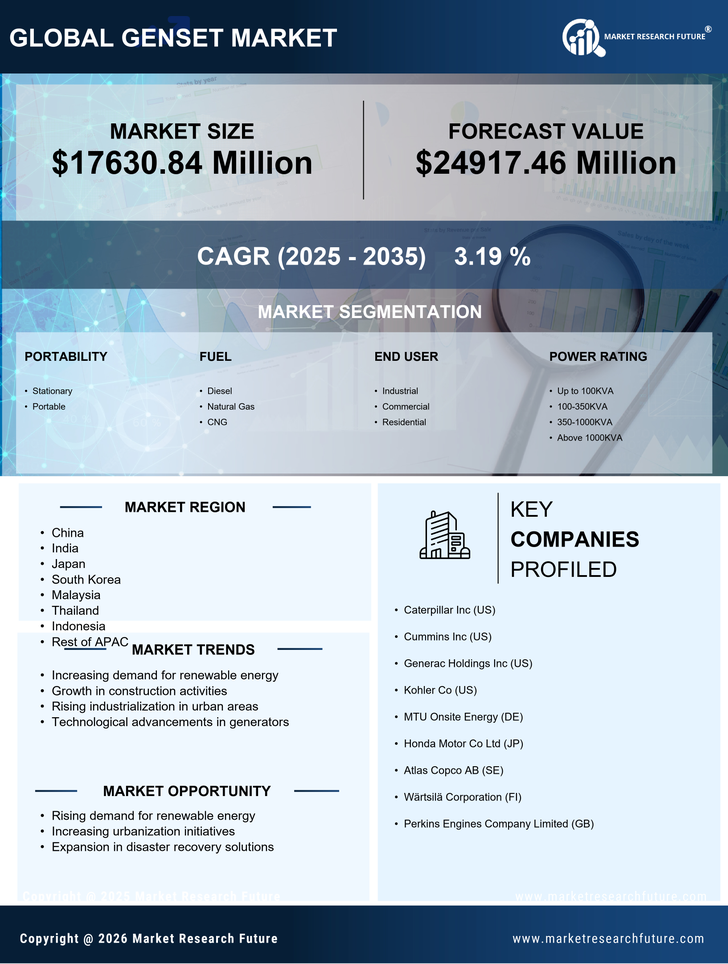

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 41.5% in the APAC genset market, valued at $6,500.0 million. Key growth drivers include rapid industrialization, urbanization, and increasing energy demands. The government's push for renewable energy and stringent regulations on emissions are shaping consumption patterns. Infrastructure projects, particularly in transportation and construction, are fueling demand for reliable power solutions.

India : Infrastructure Growth Fuels Demand

India accounts for 25.5% of the APAC genset market, valued at $4,000.0 million. The growth is driven by increasing power outages, urbanization, and a booming manufacturing sector. Government initiatives like 'Make in India' and investments in renewable energy are enhancing market dynamics. The demand for gensets is particularly high in sectors like construction, healthcare, and IT.

Japan : Innovation Meets Reliability

Japan holds a 15.9% share of the APAC genset market, valued at $2,500.0 million. The market is driven by the need for reliable backup power solutions, especially in disaster-prone areas. Government policies promoting energy efficiency and disaster preparedness are key growth factors. The demand is particularly strong in urban centers like Tokyo and Osaka, where infrastructure is critical.

South Korea : Industrial Applications Drive Market

South Korea represents 12.8% of the APAC genset market, valued at $2,000.0 million. The growth is fueled by industrial applications, particularly in manufacturing and data centers. Government regulations on energy efficiency and emissions are shaping the market landscape. Key cities like Seoul and Busan are major consumers, with a focus on high-quality, reliable gensets.

Malaysia : Infrastructure Development Sparks Growth

Malaysia holds a 7.5% share of the APAC genset market, valued at $1,200.0 million. The market is driven by infrastructure development and increasing energy needs. Government initiatives to enhance energy security and promote renewable energy are influencing demand trends. Key markets include Kuala Lumpur and Penang, where industrial growth is significant.

Thailand : Tourism and Industry Boost Demand

Thailand accounts for 6.3% of the APAC genset market, valued at $1,000.0 million. The growth is driven by the tourism sector and industrial applications. Government policies supporting energy diversification and infrastructure projects are key growth drivers. Major cities like Bangkok and Chiang Mai are central to market dynamics, with a focus on reliable power solutions.

Indonesia : Infrastructure Needs Drive Genset Sales

Indonesia represents 5.0% of the APAC genset market, valued at $800.0 million. The market is driven by increasing energy demands and infrastructure development. Government initiatives to improve energy access and reliability are shaping consumption patterns. Key markets include Jakarta and Surabaya, where industrial growth is significant and demand for gensets is rising.

Rest of APAC : Varied Applications Across Regions

The Rest of APAC accounts for 10.2% of the genset market, valued at $1,630.84 million. The growth is driven by diverse applications across various sectors, including agriculture, healthcare, and construction. Government policies promoting energy security and sustainability are influencing market dynamics. Key markets include Vietnam and the Philippines, where infrastructure development is ongoing.