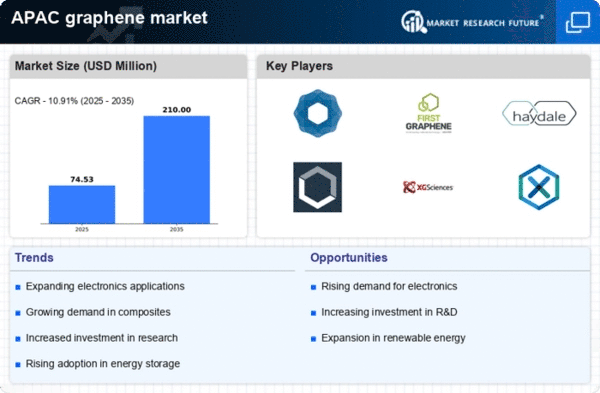

China : Unmatched Growth and Innovation

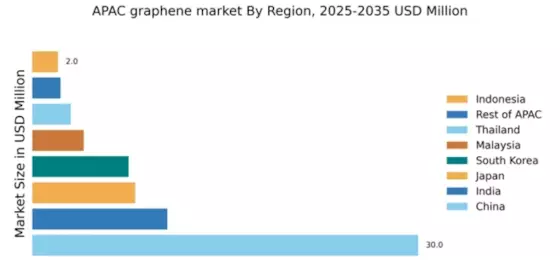

China holds a commanding 30.0% market share in the APAC graphene sector, driven by rapid industrialization and significant investments in R&D. The demand for graphene in electronics, energy storage, and composites is surging, supported by government initiatives promoting advanced materials. Regulatory frameworks are increasingly favorable, with policies aimed at enhancing innovation and sustainability in manufacturing processes. Infrastructure development, particularly in tech hubs like Shenzhen and Beijing, further fuels market growth.

India : Innovation and Investment Surge

India's graphene market accounts for 10.5% of the APAC total, reflecting a growing interest in nanotechnology and advanced materials. Key growth drivers include government support for startups and research institutions, alongside increasing applications in electronics and healthcare. The Make in India initiative encourages local production, while regulatory bodies are streamlining processes to attract foreign investment. Demand is particularly strong in urban centers like Bengaluru and Hyderabad, where tech industries thrive.

Japan : Strong R&D and Industrial Applications

Japan captures 8.0% of the APAC graphene market, bolstered by its robust research and development ecosystem. The country is a leader in integrating graphene into electronics, automotive, and energy sectors. Government policies promote innovation, with funding for research projects and collaborations between universities and industries. Cities like Tokyo and Osaka are key markets, hosting major players like Haydale Graphene Industries, which enhance the competitive landscape through cutting-edge applications.

South Korea : Strong Industrial Base and R&D

South Korea holds a 7.5% share of the APAC graphene market, driven by its advanced manufacturing capabilities and focus on high-tech applications. The government supports graphene research through funding and partnerships with universities, fostering innovation in sectors like electronics and energy. Key cities such as Seoul and Incheon are central to this growth, with major companies like Samsung investing in graphene technologies, enhancing the competitive environment and market dynamics.

Malaysia : Government Support and Innovation

Malaysia's graphene market represents 4.0% of the APAC total, with growth fueled by government initiatives aimed at promoting advanced materials. The National Graphene Action Plan encourages research and development, while local industries explore applications in construction and electronics. Key markets include Kuala Lumpur and Penang, where a burgeoning startup ecosystem is emerging. The competitive landscape features local players collaborating with international firms to enhance product offerings.

Thailand : Focus on Sustainable Applications

Thailand accounts for 3.0% of the APAC graphene market, with growth driven by increasing interest in sustainable materials. Government policies support research in green technologies, promoting graphene's use in energy-efficient applications. Key cities like Bangkok and Chiang Mai are emerging as innovation hubs, attracting investments in graphene research. The competitive landscape includes local startups and collaborations with international firms, enhancing market dynamics and opportunities.

Indonesia : Potential for Market Expansion

Indonesia's graphene market, at 2.0%, is in its nascent stages but shows promise due to rising interest in advanced materials. Government initiatives are beginning to focus on nanotechnology, with potential applications in construction and electronics. Key markets include Jakarta and Surabaya, where local industries are exploring graphene's benefits. The competitive landscape is evolving, with emerging players seeking to establish a foothold in this growing sector.

Rest of APAC : Varied Applications and Growth Drivers

The Rest of APAC holds a 2.2% share of the graphene market, characterized by diverse applications across different countries. Growth is driven by localized demand for advanced materials in sectors like automotive, electronics, and healthcare. Regulatory environments vary, with some countries offering incentives for R&D in nanotechnology. Key markets include Vietnam and the Philippines, where local players are beginning to explore graphene's potential, enhancing the competitive landscape.