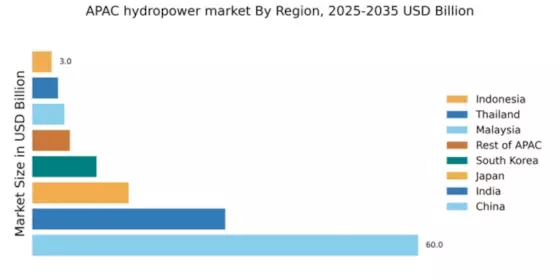

China : Unmatched Capacity and Investment

China holds a staggering 60.0% market share in the APAC hydropower sector, valued at approximately $200 billion. Key growth drivers include substantial government investments, ambitious renewable energy targets, and a robust infrastructure network. Demand is fueled by urbanization and industrialization, with policies promoting clean energy adoption. The government has implemented favorable regulations, including subsidies and tax incentives for hydropower projects, enhancing the sector's growth potential.

India : Strong Demand and Policy Support

India commands a 30.0% share of the APAC hydropower market, valued at around $100 billion. The growth is driven by increasing energy demands, government initiatives like the National Hydropower Policy, and a focus on sustainable energy. The country is witnessing a shift towards renewable sources, with hydropower being a key component. Infrastructure development, particularly in remote areas, is crucial for expanding access to hydropower.

Japan : Focus on Sustainability and Technology

Japan holds a 15.0% market share in the APAC hydropower sector, valued at approximately $50 billion. The growth is propelled by technological advancements and a strong emphasis on sustainability post-Fukushima. Government policies encourage the integration of hydropower with other renewable sources. Demand is rising in urban areas, where energy efficiency is prioritized, and aging infrastructure is being upgraded to meet modern standards.

South Korea : Government Initiatives Drive Growth

South Korea accounts for a 10.0% share of the APAC hydropower market, valued at about $30 billion. The government is actively promoting hydropower through the Renewable Energy 3020 Plan, aiming to increase the share of renewables in the energy mix. Demand is growing in urban centers, with a focus on reducing carbon emissions. Infrastructure investments are crucial for enhancing capacity and efficiency in existing plants.

Malaysia : Balancing Growth and Environment

Malaysia holds a 5.0% share of the APAC hydropower market, valued at approximately $15 billion. The growth is driven by government policies promoting renewable energy and the need for energy security. Demand is concentrated in states like Sarawak and Sabah, where hydropower projects are being developed. The competitive landscape includes local players and international firms, focusing on sustainable practices and environmental conservation.

Thailand : Sustainable Growth and Investment

Thailand has a 4.0% share of the APAC hydropower market, valued at around $12 billion. The government is committed to increasing renewable energy sources, with hydropower playing a vital role. Demand is driven by industrial growth and urbanization, particularly in regions like the North and Northeast. The market is competitive, with both local and foreign players investing in new projects and upgrades to existing facilities.

Indonesia : Potential for Future Growth

Indonesia accounts for a 3.0% share of the APAC hydropower market, valued at approximately $9 billion. The country has significant untapped hydropower potential, driven by government initiatives to enhance energy access. Demand is growing in rural areas, where electrification is a priority. The competitive landscape includes local companies and international investors, focusing on sustainable development and environmental impact assessments.

Rest of APAC : Regional Variations and Growth

The Rest of APAC holds a 5.84% share of the hydropower market, valued at around $18 billion. This sub-region includes various countries with diverse energy needs and regulatory environments. Growth is driven by local initiatives to harness renewable energy sources. Demand varies significantly, with some countries focusing on small-scale projects while others invest in large infrastructure. The competitive landscape is fragmented, with numerous local players and some international firms.