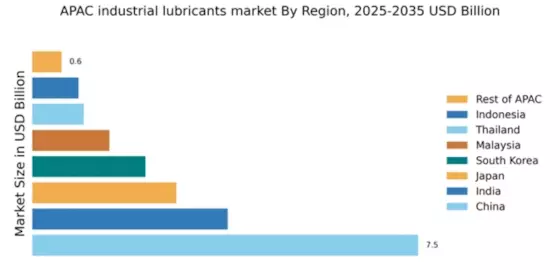

China : Robust Growth Driven by Demand

China holds a commanding 7.5% market share in the APAC industrial lubricants sector, valued at approximately $XX billion. Key growth drivers include rapid industrialization, increasing automotive production, and stringent environmental regulations promoting high-quality lubricants. The government has initiated policies to enhance manufacturing efficiency, which further boosts demand. Infrastructure development, particularly in transportation and energy sectors, is also a significant factor contributing to market expansion.

India : Strong Demand from Manufacturing Sector

India's industrial lubricants market accounts for 3.8% of the APAC share, reflecting a growing value driven by the expanding manufacturing and automotive sectors. The government's Make in India initiative has spurred local production, increasing demand for high-performance lubricants. Additionally, rising awareness of maintenance practices among industries is shaping consumption patterns, while regulatory frameworks are evolving to support sustainable practices.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 2.8%, characterized by a strong emphasis on technology and quality. The automotive and electronics industries are primary consumers, driving demand for specialized lubricants. Government initiatives focus on energy efficiency and environmental sustainability, promoting advanced lubricant formulations. The market is witnessing a shift towards bio-based lubricants, aligning with global sustainability trends.

South Korea : Strong Industrial Base and Innovation

South Korea holds a 2.2% market share, supported by a robust industrial base and technological advancements. Key growth drivers include the automotive and shipbuilding sectors, which demand high-performance lubricants. The government is actively promoting R&D in lubricant technologies, enhancing local production capabilities. Major cities like Busan and Incheon are pivotal markets, with significant presence from global players like SK Lubricants and ExxonMobil.

Malaysia : Strategic Location and Development

Malaysia's industrial lubricants market represents 1.5% of the APAC share, driven by its strategic location and growing manufacturing sector. The government is investing in infrastructure and industrial parks, attracting foreign investments. Demand is rising in sectors like automotive and manufacturing, with local players like Petronas and international firms like Shell competing vigorously. Regulatory support for sustainable practices is also shaping market dynamics.

Thailand : Diverse Applications and Industries

Thailand's market share is 1.0%, with steady growth attributed to diverse industrial applications. The automotive and agriculture sectors are significant consumers of lubricants, driving demand for both conventional and synthetic products. Government policies are increasingly focused on enhancing manufacturing efficiency and environmental sustainability. Key markets include Bangkok and Chonburi, where major players like PTT and Castrol have a strong presence.

Indonesia : Rapid Industrialization and Demand Growth

Indonesia's industrial lubricants market accounts for 0.9% of the APAC share, with potential for significant growth driven by rapid industrialization and increasing automotive production. The government is implementing policies to enhance infrastructure and support local manufacturing. Key markets include Jakarta and Surabaya, where demand for lubricants is rising across various sectors, including mining and agriculture. Local players are beginning to emerge alongside established international brands.

Rest of APAC : Opportunities Across Multiple Sectors

The Rest of APAC holds a market share of 0.57%, characterized by diverse economic conditions and varying demand for industrial lubricants. Countries like Vietnam and the Philippines are witnessing growth in manufacturing and automotive sectors, driving lubricant consumption. Regulatory frameworks are evolving to support sustainable practices, while local players are increasingly competing with global brands. The market dynamics are influenced by regional economic developments and sector-specific needs.