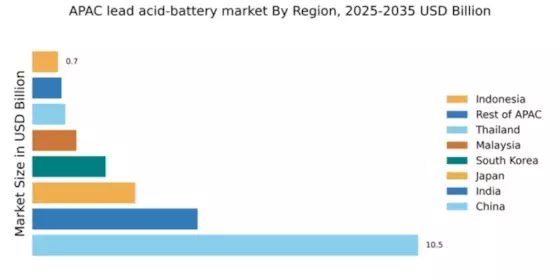

China : Unmatched Growth and Demand Trends

China holds a commanding 10.5% market share in the APAC lead acid battery sector, driven by rapid industrialization and urbanization. The demand is bolstered by the automotive sector, renewable energy storage, and government initiatives promoting electric vehicles. Regulatory policies favor local manufacturing, while infrastructure development, particularly in transportation and energy, enhances consumption patterns. The government's push for sustainable energy solutions further fuels market growth.

India : Rapid Growth in Battery Demand

India's lead acid battery market accounts for 4.5% of the APAC share, with a value driven by the automotive and telecommunications sectors. The growth is supported by rising disposable incomes and urbanization, alongside government initiatives like the National Electric Mobility Mission. Demand trends indicate a shift towards more efficient battery technologies, while local manufacturing is encouraged through favorable policies and incentives.

Japan : Innovation Driving Market Growth

Japan's market share stands at 2.8%, characterized by a strong focus on technological innovation and high-quality manufacturing. The demand is primarily driven by the automotive industry, particularly electric vehicles and hybrid models. Government policies support research and development in battery technologies, while infrastructure improvements in energy storage systems enhance consumption patterns. The market is also influenced by environmental regulations promoting sustainable practices.

South Korea : Competitive Landscape and Growth

South Korea holds a 2.0% market share in the lead acid battery sector, with significant contributions from the automotive and electronics industries. The growth is driven by increasing demand for electric vehicles and energy storage solutions. Major players like GS Yuasa dominate the market, supported by government initiatives aimed at enhancing energy efficiency. The competitive landscape is characterized by innovation and a focus on sustainability, with local manufacturers adapting to global trends.

Malaysia : Strategic Location for Battery Production

Malaysia's lead acid battery market represents 1.2% of the APAC share, driven by the automotive and industrial sectors. The growth is supported by government initiatives promoting local manufacturing and investment in infrastructure. Demand trends indicate a rising need for batteries in renewable energy applications, while regulatory policies encourage sustainable practices. The market is characterized by a mix of local and international players, enhancing competitiveness.

Thailand : Investment and Infrastructure Development

Thailand's market share is 0.9%, with growth driven by the automotive and energy sectors. The government promotes investment in battery manufacturing through incentives and infrastructure development. Demand trends show an increasing focus on electric vehicles and renewable energy storage solutions. Key cities like Bangkok and Chonburi are central to market activities, with major players establishing a strong presence to meet local needs.

Indonesia : Rising Demand for Energy Solutions

Indonesia's lead acid battery market accounts for 0.7% of the APAC share, with growth driven by the automotive and telecommunications sectors. The demand is influenced by increasing urbanization and government initiatives aimed at improving energy access. Local manufacturers are beginning to emerge, supported by favorable regulatory policies. The market dynamics are characterized by a growing interest in renewable energy applications, particularly in rural areas.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC holds a 0.8% market share in the lead acid battery sector, with diverse markets exhibiting unique growth patterns. Demand is driven by local industries, including automotive and telecommunications, with varying regulatory environments influencing market dynamics. Countries in this category are increasingly focusing on sustainable practices and local manufacturing. The competitive landscape is fragmented, with both local and international players vying for market share.