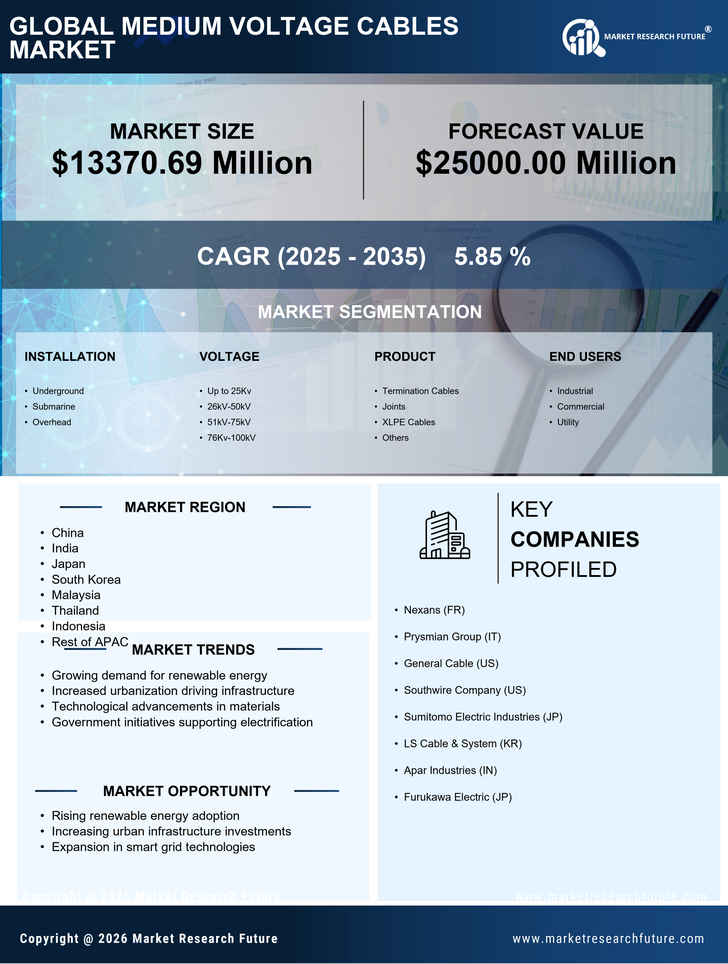

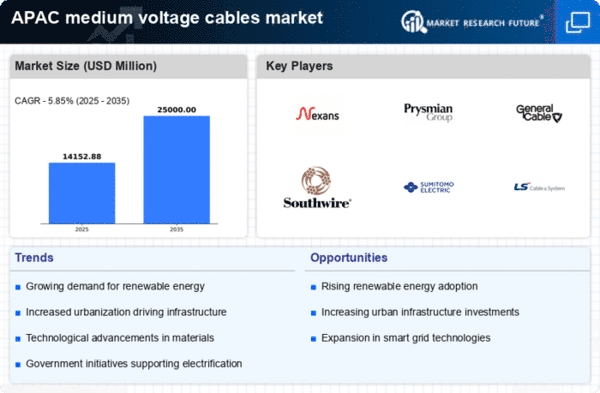

China : Unmatched Growth and Demand Trends

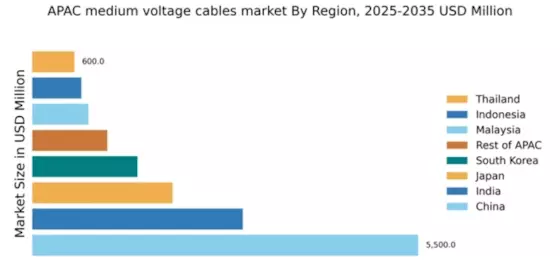

China holds a commanding market share of 45.5% in the medium voltage cables sector, valued at $5,500.0 million. Key growth drivers include rapid urbanization, increased investments in renewable energy, and government initiatives aimed at enhancing infrastructure. The demand for medium voltage cables is surging, particularly in the construction and energy sectors, supported by favorable regulatory policies that promote sustainable development and energy efficiency.

India : Infrastructure Development Fuels Growth

India's medium voltage cables market is valued at $3,000.0 million, accounting for 24.5% of the APAC market. The growth is driven by significant investments in infrastructure, smart cities, and renewable energy projects. Government initiatives like the National Electricity Policy are enhancing demand, while urbanization trends are increasing consumption patterns in metropolitan areas. Regulatory support is also fostering a conducive environment for market expansion.

Japan : Innovation Drives Market Growth

Japan's medium voltage cables market is valued at $2,000.0 million, representing 16.3% of the APAC market. The growth is propelled by technological advancements and a strong focus on energy efficiency. Demand is particularly high in sectors like manufacturing and renewable energy, supported by government policies promoting innovation and sustainability. The market is characterized by a shift towards high-performance cables to meet stringent regulations.

South Korea : Key Player in Energy Sector

South Korea's medium voltage cables market is valued at $1,500.0 million, making up 12.2% of the APAC market. The growth is driven by robust industrial demand, particularly in the energy and construction sectors. Government initiatives aimed at enhancing energy infrastructure and promoting smart grid technologies are key growth factors. The market is competitive, with major players like LS Cable & System leading the charge.

Malaysia : Growth in Renewable Energy Sector

Malaysia's medium voltage cables market is valued at $800.0 million, accounting for 6.5% of the APAC market. The growth is fueled by increasing investments in renewable energy and infrastructure development. Government policies supporting green technology and energy efficiency are enhancing demand. The market is characterized by a growing number of local players and increasing competition, particularly in urban areas like Kuala Lumpur.

Thailand : Infrastructure Projects Drive Market

Thailand's medium voltage cables market is valued at $600.0 million, representing 4.9% of the APAC market. The growth is driven by ongoing infrastructure projects and government initiatives aimed at enhancing energy efficiency. Demand is particularly strong in urban centers like Bangkok, where industrial and commercial activities are booming. The competitive landscape includes both local and international players, fostering a dynamic market environment.

Indonesia : Investment in Energy Sector Rising

Indonesia's medium voltage cables market is valued at $700.0 million, accounting for 5.7% of the APAC market. The growth is driven by increasing investments in infrastructure and energy projects, supported by government initiatives to improve electricity access. Demand trends indicate a rising consumption pattern in urban areas, particularly in Jakarta. The market is competitive, with several key players vying for market share in this emerging economy.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC medium voltage cables market is valued at $1,070.69 million, representing 8.7% of the overall market. Growth is driven by diverse factors across different countries, including infrastructure development and energy efficiency initiatives. Regulatory support varies, influencing demand trends and consumption patterns. The competitive landscape includes a mix of local and international players, catering to various sector-specific applications.