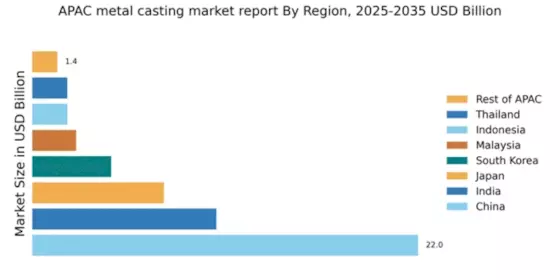

China : Unmatched Growth and Demand Trends

China holds a commanding 22.0% market share in the APAC metal casting sector, driven by rapid industrialization and urbanization. Key growth drivers include the automotive and aerospace industries, which are experiencing robust demand. Government initiatives, such as the Made in China 2025 plan, aim to enhance manufacturing capabilities. Additionally, significant investments in infrastructure and technology are fostering a conducive environment for metal casting operations.

India : Strong Demand from Diverse Sectors

India's metal casting market accounts for 10.5% of the APAC share, valued at approximately $X billion. The automotive, construction, and consumer goods sectors are key growth drivers, with increasing domestic consumption patterns. Government initiatives like the Make in India campaign are bolstering manufacturing capabilities. Furthermore, investments in smart cities and infrastructure development are enhancing the industrial landscape.

Japan : Precision and Quality at Forefront

Japan's metal casting market holds a 7.5% share in APAC, valued at around $X billion. The country is known for its advanced technology and high-quality standards, particularly in the automotive and electronics sectors. Growth is driven by innovation in materials and processes, supported by government policies promoting R&D. The focus on sustainability and eco-friendly practices is also shaping demand trends.

South Korea : Focus on High-Tech Applications

South Korea represents 4.5% of the APAC metal casting market, valued at approximately $X billion. The automotive and shipbuilding industries are significant growth drivers, with increasing demand for lightweight and durable materials. Government support through subsidies and innovation grants is fostering a competitive environment. The country's advanced infrastructure and skilled workforce further enhance its market position.

Malaysia : Diverse Applications and Investments

Malaysia's metal casting market accounts for 2.5% of the APAC share, valued at around $X billion. Key growth drivers include the automotive and electronics sectors, with rising domestic consumption patterns. Government initiatives aimed at enhancing manufacturing capabilities are crucial. The development of industrial parks and clusters is also facilitating growth in this sector.

Thailand : Export-Oriented Growth Dynamics

Thailand holds a 2.0% share in the APAC metal casting market, valued at approximately $X billion. The automotive and machinery sectors are primary growth drivers, supported by increasing exports. Government policies promoting foreign investment and trade are enhancing the business environment. Key industrial zones, such as the Eastern Economic Corridor, are pivotal for attracting major players.

Indonesia : Investment Opportunities in Casting

Indonesia's metal casting market represents 2.0% of the APAC share, valued at around $X billion. The automotive and construction sectors are key growth drivers, with rising domestic demand. Government initiatives to improve infrastructure and manufacturing capabilities are crucial. The competitive landscape is evolving, with local players gaining traction alongside international firms.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC accounts for 1.43% of the metal casting market, valued at approximately $X billion. Growth is driven by localized demand in sectors like construction and consumer goods. Regulatory policies vary significantly, impacting market dynamics. Emerging markets in this category are focusing on enhancing manufacturing capabilities and attracting foreign investment to boost growth.