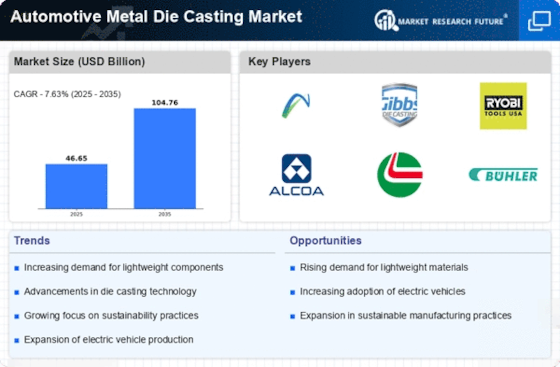

Growth in Electric Vehicle Production

The Automotive Metal Die Casting Market is poised for growth due to the rising production of electric vehicles (EVs). As governments and consumers alike push for cleaner transportation options, the demand for EVs is escalating. Metal die casting is integral to the manufacturing of various components in electric vehicles, such as battery housings and structural parts. Recent statistics indicate that the electric vehicle market is expected to expand at a staggering rate, with projections suggesting a market size of over 800 billion dollars by 2027. This burgeoning sector presents a significant opportunity for the Automotive Metal Die Casting Market, as manufacturers seek efficient and cost-effective production methods to meet the increasing demand for EV components.

Increasing Demand for Fuel Efficiency

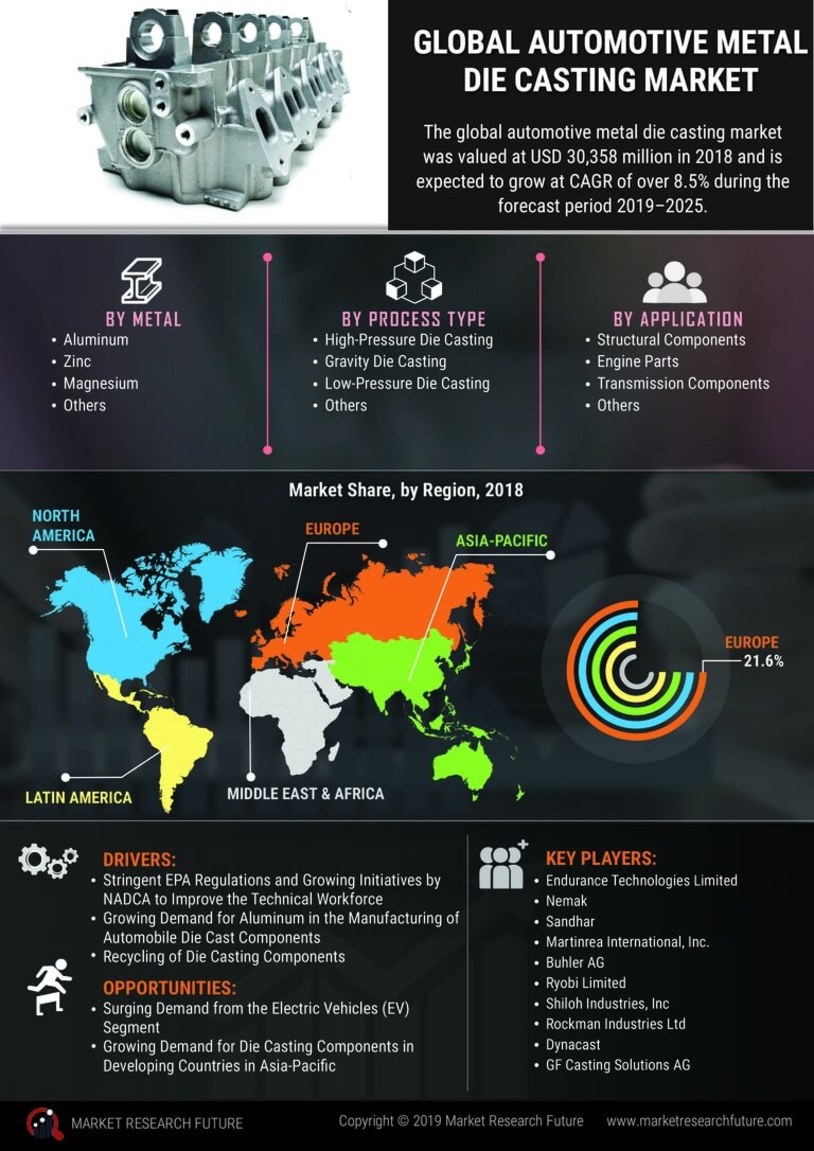

The Automotive Metal Die Casting Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, automakers are compelled to innovate and produce lighter vehicles that consume less fuel. Metal die casting plays a crucial role in this transition, as it allows for the production of lightweight components without compromising strength. According to recent data, the automotive sector is projected to witness a compound annual growth rate of approximately 4.5% in the coming years, driven by the need for enhanced fuel efficiency. This trend is likely to propel the Automotive Metal Die Casting Market, as manufacturers increasingly adopt die casting techniques to meet these evolving consumer preferences.

Technological Innovations in Die Casting

Technological advancements are reshaping the Automotive Metal Die Casting Market, enhancing production efficiency and product quality. Innovations such as 3D printing and advanced simulation software are enabling manufacturers to optimize die designs and reduce production times. These technologies not only improve the precision of cast components but also minimize material waste, aligning with sustainability goals. The integration of automation and robotics in die casting processes is further streamlining operations, leading to cost reductions and increased output. As the industry embraces these technological innovations, the Automotive Metal Die Casting Market is likely to witness a transformation, characterized by improved competitiveness and enhanced product offerings.

Regulatory Support for Advanced Manufacturing

The Automotive Metal Die Casting Market is benefiting from regulatory support aimed at promoting advanced manufacturing practices. Governments are implementing policies that encourage the adoption of innovative manufacturing technologies, including die casting, to enhance productivity and competitiveness. These initiatives often include financial incentives, research grants, and tax breaks for companies investing in advanced manufacturing capabilities. As a result, manufacturers in the Automotive Metal Die Casting Market are more likely to invest in state-of-the-art equipment and processes, leading to improved efficiency and product quality. This supportive regulatory environment is expected to foster growth in the Automotive Metal Die Casting Market, as companies leverage these opportunities to enhance their manufacturing capabilities.

Rising Consumer Preferences for Customization

The Automotive Metal Die Casting Market is influenced by a growing consumer preference for vehicle customization. As consumers seek unique features and personalized designs, automakers are increasingly turning to die casting to produce bespoke components that cater to these demands. This trend is particularly evident in the luxury and performance vehicle segments, where customization options are a key selling point. The ability to create intricate designs and lightweight parts through die casting allows manufacturers to differentiate their offerings in a competitive market. Consequently, this shift towards customization is expected to drive growth in the Automotive Metal Die Casting Market, as manufacturers invest in advanced die casting technologies to meet consumer expectations.