Cost Efficiency

Cost efficiency remains a critical driver in the Automotive Aluminum Parts High-pressure Die Casting (HPDC) Market. The adoption of aluminum die casting processes has been shown to reduce production costs significantly compared to traditional manufacturing methods. The ability to produce complex geometries with minimal waste enhances the economic viability of aluminum components. Recent analyses indicate that the use of HPDC can lower manufacturing costs by approximately 20 to 30%, making it an attractive option for automotive manufacturers. Additionally, the durability and longevity of aluminum parts reduce the need for frequent replacements, further contributing to cost savings over the vehicle's lifecycle. As automotive companies seek to optimize their production processes and improve profit margins, the cost efficiency associated with HPDC is likely to drive market growth.

Lightweighting Trends

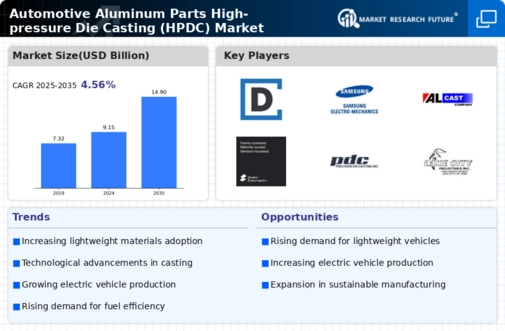

The Automotive Aluminum Parts High-pressure Die Casting (HPDC) Market is experiencing a pronounced shift towards lightweight materials. This trend is driven by the automotive sector's increasing emphasis on fuel efficiency and reduced emissions. Aluminum, being significantly lighter than traditional materials, allows manufacturers to produce components that contribute to overall vehicle weight reduction. According to recent data, vehicles that utilize aluminum parts can achieve up to a 30% reduction in weight, which directly correlates with improved fuel economy. As automakers strive to meet stringent regulatory standards, the demand for aluminum parts is likely to escalate, thereby propelling the growth of the HPDC market. Furthermore, lightweighting not only enhances performance but also supports sustainability initiatives, making it a pivotal driver in the industry.

Regulatory Compliance

The Automotive Aluminum Parts High-pressure Die Casting (HPDC) Market is significantly influenced by the increasing regulatory pressures aimed at reducing vehicle emissions and enhancing safety standards. Governments worldwide are implementing stringent regulations that require automakers to adopt more sustainable practices. Aluminum components, known for their recyclability and lower environmental impact, align well with these regulatory frameworks. For instance, regulations mandating lower CO2 emissions are pushing manufacturers to incorporate lightweight materials like aluminum, which can help achieve compliance. As a result, the demand for aluminum parts produced through HPDC is expected to rise, as automakers seek to meet these evolving standards while maintaining competitive advantages in the market.

Technological Innovations

Technological innovations play a pivotal role in shaping the Automotive Aluminum Parts High-pressure Die Casting (HPDC) Market. Advances in die casting technology, such as improved mold designs and enhanced cooling techniques, have led to higher precision and quality in aluminum parts production. These innovations not only increase the efficiency of the manufacturing process but also expand the range of applications for aluminum components in vehicles. For example, the introduction of automated systems and real-time monitoring has improved production consistency and reduced cycle times. As automotive manufacturers continue to invest in cutting-edge technologies, the HPDC market is likely to benefit from increased demand for high-quality aluminum parts that meet the evolving needs of the industry.

Electric Vehicle Integration

The rise of electric vehicles (EVs) is emerging as a significant driver for the Automotive Aluminum Parts High-pressure Die Casting (HPDC) Market. As the automotive landscape shifts towards electrification, the demand for lightweight and efficient components becomes paramount. Aluminum parts are increasingly favored in EV production due to their ability to reduce overall vehicle weight, thereby enhancing battery efficiency and extending range. Recent projections suggest that the EV market could grow exponentially, with aluminum playing a crucial role in the design and manufacturing of these vehicles. Consequently, the HPDC market is poised for growth as automakers seek to integrate aluminum components into their electric vehicle platforms, aligning with the industry's broader transition towards sustainable mobility.