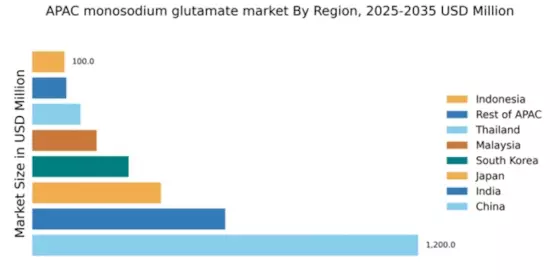

China : Unmatched Production and Consumption

China holds a staggering 60% market share in the APAC monosodium glutamate market, valued at $1200.0 million. Key growth drivers include rising consumer demand for flavor enhancers in food products, coupled with increasing urbanization and disposable income. Regulatory support for food safety and quality standards has bolstered production capabilities. Infrastructure improvements in logistics and manufacturing have further facilitated market growth, making China a powerhouse in MSG production.

India : Emerging Market with High Demand

India accounts for 15% of the APAC monosodium glutamate market, valued at $600.0 million. The growth is driven by increasing consumption in processed foods and snacks, alongside a growing restaurant industry. Government initiatives promoting food processing and safety standards are enhancing market dynamics. The rise of e-commerce platforms is also facilitating wider distribution of MSG products across urban and rural areas.

Japan : Culinary Tradition Meets Innovation

Japan holds a 10% share of the APAC monosodium glutamate market, valued at $400.0 million. The market is driven by a strong culinary culture that values umami flavors, leading to consistent demand for MSG in various food applications. Regulatory frameworks ensure high safety standards, fostering consumer trust. The country's advanced food technology sector is also innovating MSG applications, enhancing its market presence.

South Korea : A Hub for Flavor Innovation

South Korea represents 7.5% of the APAC monosodium glutamate market, valued at $300.0 million. The growth is fueled by a booming food service industry and increasing consumer interest in flavor-enhancing products. Government regulations support food safety and quality, while local companies are investing in R&D for innovative MSG applications. The competitive landscape includes major players like Ajinomoto, which has a significant market presence.

Malaysia : Strategic Location for Distribution

Malaysia captures 5% of the APAC monosodium glutamate market, valued at $200.0 million. The market is driven by rising demand in the food processing sector and a growing population. Government initiatives to boost the food industry and improve infrastructure are key growth factors. The competitive landscape features local and international players, with Kuala Lumpur being a central hub for distribution and logistics.

Thailand : A Flavorful Market Landscape

Thailand holds a 3.75% share of the APAC monosodium glutamate market, valued at $150.0 million. The growth is attributed to the country's rich culinary heritage, which emphasizes flavor enhancement in traditional dishes. Regulatory policies support food safety, while local manufacturers are expanding their product lines. Bangkok serves as a key market, with a competitive landscape featuring both local and international brands.

Indonesia : Rising Demand for Flavor Enhancers

Indonesia accounts for 2.5% of the APAC monosodium glutamate market, valued at $100.0 million. The market is driven by increasing urbanization and a growing middle class, leading to higher consumption of processed foods. Government initiatives to improve food safety and quality standards are fostering market growth. Key cities like Jakarta are pivotal for market dynamics, with local players gaining traction in the competitive landscape.

Rest of APAC : Varied Demand Across Regions

The Rest of APAC holds a 2.65% share of the monosodium glutamate market, valued at $106.0 million. This sub-region showcases diverse consumption patterns influenced by local cuisines and food preferences. Regulatory frameworks vary, impacting market dynamics differently across countries. The competitive landscape includes both local and international players, with opportunities for growth in niche markets and specialty applications.

Leave a Comment