China : Rapid Growth and Urban Demand

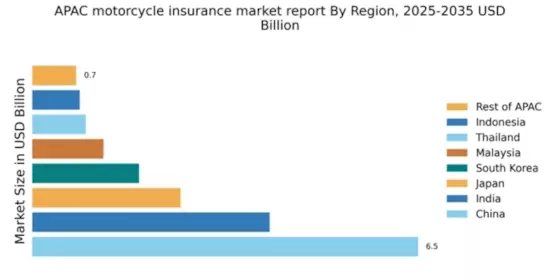

China holds a significant market share of 6.5% in the APAC motorcycle insurance sector, driven by increasing urbanization and a growing middle class. The demand for motorcycle insurance is bolstered by government initiatives promoting road safety and insurance penetration. Regulatory policies are evolving to enhance consumer protection, while infrastructure development, particularly in urban areas, supports the rising number of motorcycle registrations.

India : Youthful Demographics Drive Growth

India's motorcycle insurance market accounts for 4.0% of the APAC total, fueled by a youthful population and rising disposable incomes. The demand is further supported by government initiatives aimed at increasing insurance coverage among two-wheeler owners. Regulatory frameworks are being strengthened to ensure fair practices, while the expanding network of roads and highways enhances accessibility for motorcycle users.

Japan : Cultural Factors Influence Insurance

Japan's motorcycle insurance market holds a 2.5% share in APAC, characterized by a mature consumer base and unique cultural factors. The demand is driven by a strong emphasis on safety and reliability, with government policies promoting comprehensive insurance coverage. The aging population is also influencing consumption patterns, leading to a shift towards more secure and reliable insurance products.

South Korea : Tech-Driven Market Dynamics

South Korea's motorcycle insurance market represents 1.8% of the APAC total, with innovation playing a key role in its growth. The demand for insurance is driven by technological advancements and a strong regulatory framework that encourages digital solutions. Government initiatives are focused on enhancing consumer awareness and promoting safe riding practices, contributing to a more informed customer base.

Malaysia : Cultural Diversity Shapes Insurance

Malaysia's motorcycle insurance market accounts for 1.2% of the APAC share, driven by a diverse population and varying insurance needs. The demand is supported by government policies aimed at increasing insurance literacy and accessibility. Infrastructure improvements, particularly in urban areas, are facilitating motorcycle ownership, while local regulations are adapting to meet the needs of a growing market.

Thailand : Key Market for Tourists and Locals

Thailand's motorcycle insurance market holds a 0.9% share in APAC, significantly influenced by tourism and local demand. The government promotes motorcycle insurance through initiatives aimed at enhancing road safety for both tourists and residents. The competitive landscape includes local and international players, with a focus on tailored products for diverse customer segments, including tourists.

Indonesia : Rapid Growth in Motorcycle Ownership

Indonesia's motorcycle insurance market represents 0.8% of the APAC total, with rapid growth driven by increasing motorcycle ownership among the population. Government initiatives are focused on improving insurance penetration and consumer education. The competitive landscape is evolving, with both local and international players vying for market share, while urbanization continues to drive demand for insurance products.

Rest of APAC : Diverse Opportunities Across Regions

The Rest of APAC accounts for 0.74% of the motorcycle insurance market, characterized by diverse regulatory environments and consumer preferences. Demand trends vary significantly across countries, influenced by local economic conditions and cultural factors. The competitive landscape includes a mix of regional players and global insurers, each adapting to local market dynamics and consumer needs.