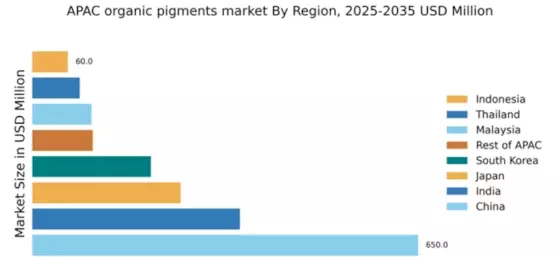

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 65% in the organic pigments sector, valued at $650.0 million. Key growth drivers include rapid industrialization, increasing demand from the coatings and plastics industries, and government initiatives promoting sustainable practices. Regulatory policies are becoming more stringent, pushing manufacturers towards eco-friendly solutions. Infrastructure development, particularly in urban areas, is enhancing production capabilities and distribution networks.

India : Rapid Growth in Diverse Sectors

Key markets include Maharashtra and Gujarat, where major industrial hubs are located. The competitive landscape features players like BASF and Clariant, which are expanding their footprint. Local dynamics favor innovation and customization, with a focus on eco-friendly products. The textile and paint industries are significant consumers of organic pigments, driving demand further.

Japan : High-Quality Standards and Applications

Tokyo and Osaka are key markets, hosting major manufacturers like DIC Corporation and Toyo Ink. The competitive landscape is characterized by innovation and high-quality standards. Local market dynamics favor advanced applications in electronics and automotive coatings, with a strong emphasis on R&D to meet evolving consumer needs.

South Korea : Innovative Solutions for Modern Applications

Seoul and Busan are key markets, with major players like Huntsman and Ferro Corporation establishing a strong presence. The competitive landscape is marked by a focus on innovation and high-performance products. Local dynamics favor sectors like electronics and automotive coatings, where advanced pigment solutions are increasingly sought after.

Malaysia : Focus on Eco-Friendly Solutions

Key markets include Selangor and Penang, where industrial activities are concentrated. The competitive landscape features players like BASF and local manufacturers focusing on sustainability. Local market dynamics favor the coatings and plastics sectors, with a growing emphasis on environmentally friendly products and practices.

Thailand : Diverse Applications Driving Demand

Bangkok and Chonburi are key markets, with a mix of local and international players like Clariant and Huntsman. The competitive landscape is characterized by a focus on innovation and quality. Local dynamics favor diverse applications, particularly in textiles and coatings, driving demand for organic pigments.

Indonesia : Growth Driven by Local Industries

Jakarta and Surabaya are key markets, with local players and international companies like BASF establishing a presence. The competitive landscape is marked by a focus on innovation and local adaptation. Local dynamics favor the construction and automotive sectors, where demand for organic pigments is on the rise.

Rest of APAC : Varied Applications Across Sub-Regions

Key markets include Vietnam and the Philippines, where local industries are expanding. The competitive landscape features a mix of local and international players, with a focus on innovation and quality. Local dynamics favor sectors like textiles and coatings, driving demand for organic pigments.