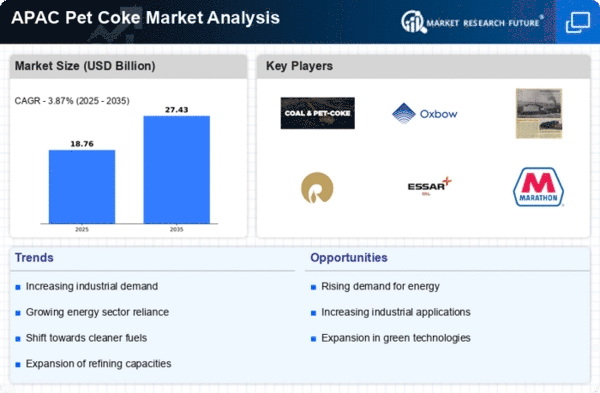

Rising Steel Production in APAC

The steel production sector in APAC is a significant driver for the pet coke market. As countries like China and India ramp up their steel manufacturing capabilities, the demand for metallurgical coke, a derivative of pet coke, is expected to rise. The pet coke market is likely to benefit from this trend, as it serves as a crucial input in the production of metallurgical coke. In 2025, the steel industry is projected to account for around 25% of the total pet coke consumption in the region. This growth is fueled by the increasing infrastructure development and urbanization in APAC, which necessitates higher steel output. As a result, the pet coke market may experience a surge in demand, prompting manufacturers to enhance their production capacities to meet the needs of the steel sector.

Investment in Petrochemical Sector

The ongoing investment in the petrochemical sector within APAC is driving the pet coke market. As countries enhance their petrochemical production capabilities, the demand for pet coke as a feedstock is likely to increase. The pet coke market is expected to see a rise in consumption from petrochemical plants, which utilize pet coke for various applications, including the production of chemicals and plastics. In 2025, it is estimated that the petrochemical sector could account for approximately 20% of the total pet coke demand in the region. This trend is indicative of a broader shift towards diversifying energy sources and optimizing resource utilization, thereby creating new opportunities for growth within the pet coke market.

Growth in Power Generation Capacity

The expansion of power generation capacity in APAC is significantly influencing the pet coke market. As countries strive to meet their growing energy needs, there is a noticeable shift towards utilizing pet coke as a fuel source in thermal power plants. The pet coke market is poised to benefit from this trend, as it offers a higher calorific value compared to traditional fuels. In 2025, it is anticipated that the power generation sector will consume approximately 30% of the total pet coke produced in the region. This growth is driven by the need for reliable and affordable energy solutions, particularly in developing nations where energy demand is surging. Consequently, the pet coke market is likely to see increased investments and infrastructure development to support this growing demand.

Emerging Export Markets for Pet Coke

The emergence of new export markets for pet coke in APAC is a notable driver for the market. As countries within the region seek to expand their trade relationships, the demand for pet coke in international markets is likely to grow. The pet coke market stands to benefit from this trend, as it positions itself as a competitive supplier to countries with increasing energy needs. In 2025, it is projected that exports could account for around 15% of the total pet coke production in APAC. This growth in export potential is driven by the rising energy demands in neighboring regions, creating opportunities for producers to tap into new markets and enhance their profitability within the pet coke market.

Increasing Industrialization in APAC

The rapid pace of industrialization across APAC countries is a primary driver for the pet coke market. As nations like India and China continue to expand their manufacturing capabilities, the demand for energy-intensive fuels such as pet coke is likely to rise. The pet coke market benefits from this trend, as it serves as a cost-effective alternative to coal and natural gas in various industrial applications. In 2025, the cement and power generation sectors are projected to account for a substantial share of pet coke consumption, with estimates suggesting that these sectors could represent over 60% of the total demand in the region. This increasing industrial activity is expected to bolster the market further, creating opportunities for growth and investment in the pet coke market.