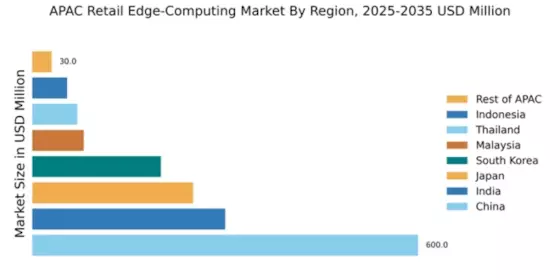

China : Unmatched Growth and Innovation

China holds a commanding market share of 40% in the APAC retail edge-computing sector, valued at $600.0 million. Key growth drivers include rapid urbanization, increasing IoT adoption, and government initiatives promoting digital transformation. The demand for low-latency applications is surging, particularly in sectors like retail and manufacturing. Regulatory support, such as the "New Infrastructure" initiative, is fostering a conducive environment for edge computing investments, while robust infrastructure development is enhancing connectivity and service delivery.

India : Innovation and Investment Surge

India's retail edge-computing market is valued at $300.0 million, accounting for 20% of the APAC share. The growth is driven by increasing smartphone penetration, a burgeoning e-commerce sector, and supportive government policies like "Digital India." Demand for real-time data processing is rising, particularly in urban centers. The government is also investing in smart city projects, which are expected to boost edge computing applications across various sectors.

Japan : Strong Focus on Automation

Japan's market for retail edge computing is valued at $250.0 million, representing 16.67% of the APAC market. The growth is fueled by advancements in AI and robotics, alongside a strong emphasis on automation in industries such as retail and logistics. Government initiatives promoting smart factories and digital transformation are also pivotal. The demand for edge solutions is particularly high in urban areas like Tokyo and Osaka, where high-density data processing is essential.

South Korea : Innovation in Urban Environments

South Korea's retail edge-computing market is valued at $200.0 million, making up 13.33% of the APAC share. The growth is driven by the country's advanced telecommunications infrastructure and a strong focus on smart city initiatives. Demand for edge computing is particularly high in cities like Seoul and Busan, where real-time data processing is critical. Major players like Samsung and LG are investing heavily in edge technologies, enhancing the competitive landscape.

Malaysia : Government Support and Growth Potential

Malaysia's retail edge-computing market is valued at $80.0 million, accounting for 5.33% of the APAC market. The growth is supported by government initiatives like the "Malaysia Digital Economy Blueprint," which aims to enhance digital infrastructure. Demand is rising in sectors such as retail and logistics, driven by the need for efficient data processing. Key cities like Kuala Lumpur are becoming hubs for edge computing applications, attracting investments from major players.

Thailand : Investment in Digital Infrastructure

Thailand's retail edge-computing market is valued at $70.0 million, representing 4.67% of the APAC share. The growth is driven by increasing internet penetration and government initiatives aimed at enhancing digital infrastructure. Demand for edge computing is particularly strong in Bangkok, where urbanization is accelerating. Local players are collaborating with international firms to enhance service offerings, creating a competitive landscape that fosters innovation.

Indonesia : Rising Digital Adoption Trends

Indonesia's retail edge-computing market is valued at $54.33 million, making up 3.62% of the APAC market. The growth is driven by increasing smartphone usage and a growing e-commerce sector. Government initiatives aimed at improving digital infrastructure are also pivotal. Key cities like Jakarta are witnessing a surge in demand for edge solutions, particularly in retail and logistics, as businesses seek to enhance operational efficiency.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC region's retail edge-computing market is valued at $30.0 million, accounting for 2% of the overall market. Growth is driven by varying levels of digital adoption and infrastructure development across countries. Demand trends are influenced by local industries, with sectors like healthcare and manufacturing showing increasing interest in edge solutions. The competitive landscape is fragmented, with both local and international players vying for market share.