China : Unmatched Growth and Innovation

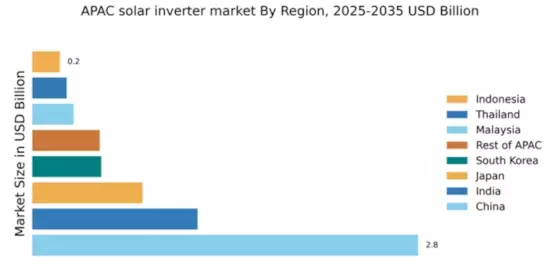

China holds a commanding market share of 2.8 in the APAC solar inverter market, driven by rapid industrialization and government support for renewable energy. The country's ambitious policies, such as the 14th Five-Year Plan, aim to increase solar capacity significantly. Demand is fueled by urbanization and a shift towards sustainable energy solutions, with major investments in infrastructure and technology development.

India : Government Initiatives Fuel Growth

India's solar inverter market is valued at 1.2, reflecting a robust growth trajectory. Key drivers include the government's Solar Mission, which aims for 100 GW of solar power by 2022. Demand is rising due to increasing energy needs and a focus on clean energy. The regulatory framework supports solar projects, enhancing investment opportunities and infrastructure development across the country.

Japan : Technological Advancements Drive Demand

Japan's solar inverter market, valued at 0.8, is characterized by a strong emphasis on technology and innovation. The government promotes renewable energy through feed-in tariffs and subsidies, encouraging residential and commercial solar installations. Demand is driven by energy security concerns and a shift towards sustainable practices, with significant investments in R&D and infrastructure.

South Korea : Strong Policy Support and Investment

South Korea's solar inverter market is valued at 0.5, supported by government initiatives like the Renewable Energy 3020 Plan, which aims for 20% of energy from renewables by 2030. Demand is growing due to urbanization and industrial energy needs. The competitive landscape features local and international players, with a focus on smart grid technologies and energy efficiency.

Malaysia : Government Incentives Boost Market

Malaysia's solar inverter market, valued at 0.3, is experiencing growth driven by government incentives and a commitment to renewable energy. The Net Energy Metering (NEM) scheme encourages residential solar installations, while industrial sectors are increasingly adopting solar solutions. Demand is rising as businesses seek to reduce energy costs and carbon footprints, supported by infrastructure development.

Thailand : Strong Solar Policies and Investments

Thailand's solar inverter market is valued at 0.25, bolstered by the government's Power Development Plan, which emphasizes renewable energy. Demand is driven by both residential and commercial sectors, with increasing awareness of sustainability. The competitive landscape includes local and international players, focusing on innovative solar technologies and applications in agriculture and industry.

Indonesia : Growing Interest in Solar Solutions

Indonesia's solar inverter market, valued at 0.2, is in its nascent stages but shows significant potential for growth. Government initiatives like the 2025 Renewable Energy Target aim to increase solar capacity. Demand is driven by the need for energy access in remote areas and a growing interest in sustainable solutions. Infrastructure development is crucial for market expansion.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC solar inverter market, valued at 0.49, encompasses diverse countries with varying growth rates. Demand trends are influenced by local regulations and energy needs. Countries like Vietnam and the Philippines are emerging markets, while others face challenges in infrastructure and investment. The competitive landscape includes both local and international players, adapting to regional dynamics.